Rise in Cyber Threats

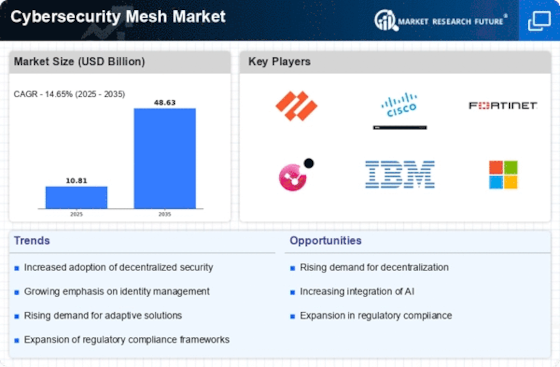

The Cybersecurity Mesh Market is experiencing a notable surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are facing a myriad of challenges, including ransomware attacks, data breaches, and phishing schemes. According to recent data, cybercrime is projected to cost businesses over 10 trillion dollars annually by 2025. This alarming trend compels enterprises to adopt more robust security frameworks, leading to a heightened interest in cybersecurity mesh architectures. These frameworks offer a decentralized approach, allowing organizations to secure their digital assets more effectively. As a result, the Cybersecurity Mesh Market is likely to witness substantial growth as businesses prioritize investments in advanced security solutions to mitigate risks associated with evolving cyber threats.

Adoption of Remote Work Policies

The shift towards remote work has significantly influenced the Cybersecurity Mesh Market. As organizations embrace flexible work arrangements, the traditional perimeter-based security models are becoming increasingly inadequate. The need for secure access to corporate resources from various locations has prompted businesses to explore decentralized security solutions. Cybersecurity mesh architectures facilitate secure connections for remote employees, ensuring that sensitive data remains protected regardless of the user's location. This trend is underscored by the fact that nearly 70% of organizations have adopted remote work policies, further driving the demand for innovative cybersecurity solutions. Consequently, the Cybersecurity Mesh Market is poised for growth as companies seek to enhance their security posture in a remote work environment.

Regulatory Compliance Requirements

The Cybersecurity Mesh Market is significantly influenced by the growing emphasis on regulatory compliance. Governments and regulatory bodies are increasingly mandating stringent security measures to protect sensitive data. For instance, regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose heavy penalties for non-compliance. Organizations are compelled to adopt comprehensive cybersecurity strategies to meet these requirements, leading to a surge in demand for cybersecurity mesh solutions. These architectures provide a flexible framework that can adapt to various compliance standards, ensuring that organizations can maintain regulatory adherence while securing their digital assets. As compliance becomes a critical focus, the Cybersecurity Mesh Market is expected to expand as businesses invest in solutions that align with regulatory expectations.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is reshaping the Cybersecurity Mesh Market. These technologies enhance threat detection and response capabilities, allowing organizations to identify vulnerabilities and respond to incidents more effectively. AI-driven analytics can process vast amounts of data, enabling proactive security measures that are essential in today's threat landscape. The market for AI in cybersecurity is projected to reach 38 billion dollars by 2026, indicating a robust growth trajectory. As organizations increasingly recognize the value of these technologies, the demand for cybersecurity mesh architectures that incorporate AI and ML is likely to rise. This trend suggests that the Cybersecurity Mesh Market will continue to evolve, driven by the need for innovative solutions that leverage advanced technologies.

Increased Investment in Cybersecurity

The Cybersecurity Mesh Market is witnessing a surge in investment as organizations prioritize cybersecurity in their budgets. With the rising costs associated with cyber incidents, businesses are allocating more resources to enhance their security frameworks. Recent reports indicate that global spending on cybersecurity is expected to exceed 200 billion dollars by 2024. This trend reflects a growing recognition of the importance of robust cybersecurity measures in safeguarding digital assets. As organizations seek to implement more effective security solutions, the demand for cybersecurity mesh architectures is likely to increase. These frameworks offer a scalable and adaptable approach to security, making them an attractive option for organizations looking to optimize their cybersecurity investments. Consequently, the Cybersecurity Mesh Market is positioned for significant growth as businesses continue to prioritize cybersecurity in their strategic planning.