North America : Innovation and Leadership Hub

North America leads the global market for Crop Yield Prediction Services, holding a significant share of 1.25B in 2024. The region's growth is driven by advanced agricultural technologies, increasing demand for precision farming, and supportive government policies promoting sustainable practices. Regulatory frameworks are evolving to encourage innovation, enhancing the adoption of data-driven solutions in agriculture.

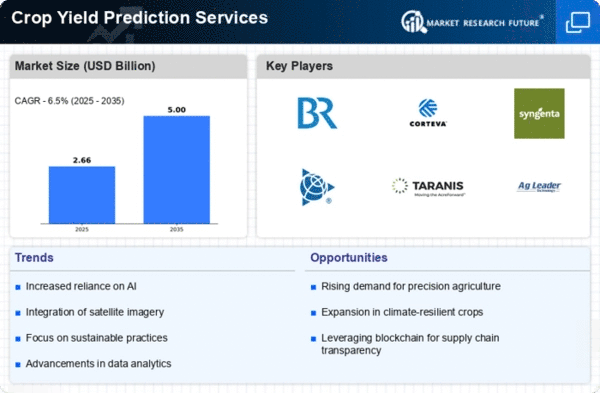

The competitive landscape is robust, with key players like Corteva, Bayer, and Trimble leading the charge. The U.S. and Canada are at the forefront, leveraging cutting-edge technologies and extensive research capabilities. The presence of major companies fosters a dynamic environment, ensuring continuous advancements in crop yield prediction methodologies. This region's commitment to agricultural efficiency positions it as a global leader.

Europe : Sustainable Agriculture Focus

Europe's market for Crop Yield Prediction Services is valued at 0.75B, reflecting a growing emphasis on sustainable agricultural practices. The region is witnessing increased demand for precision farming solutions, driven by environmental regulations and the need for food security. Initiatives from the European Union aim to enhance agricultural productivity while minimizing environmental impact, creating a favorable regulatory landscape for innovation.

Leading countries such as Germany, France, and the Netherlands are at the forefront of this market, supported by a strong presence of key players like Syngenta and Bayer. The competitive environment is characterized by collaborations between technology firms and agricultural stakeholders, fostering innovation. The focus on sustainability and efficiency in farming practices is shaping the future of crop yield prediction services in Europe.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 0.4B, is rapidly emerging in the Crop Yield Prediction Services sector. The growth is fueled by increasing agricultural productivity demands, rising population, and the adoption of smart farming technologies. Governments are investing in agricultural innovation, creating a conducive environment for the development of predictive analytics in farming practices.

Countries like China, India, and Australia are leading the charge, with significant investments in agricultural technology. The competitive landscape includes local and international players, such as Taranis and Farmers Edge, who are leveraging advanced technologies to enhance crop yield predictions. The region's diverse agricultural landscape presents unique opportunities for tailored solutions, driving market expansion.

Middle East and Africa : Resource-Rich Agricultural Frontier

The Middle East and Africa region, with a market size of 0.1B, presents significant untapped potential in Crop Yield Prediction Services. The growth is driven by increasing agricultural investments and the need for food security in the face of climate challenges. Governments are beginning to recognize the importance of data-driven agriculture, leading to emerging regulatory frameworks that support innovation in farming practices.

Countries like South Africa and Kenya are taking the lead in adopting agricultural technologies, with a growing presence of key players such as Sentera. The competitive landscape is evolving, with local startups and international firms collaborating to enhance agricultural productivity. The region's unique challenges and opportunities create a fertile ground for the development of crop yield prediction services.