Growing Focus on Soil Health

Soil health has emerged as a critical factor in agricultural productivity, leading to a heightened interest in the crop micronutrient Market. Healthy soil is essential for optimal nutrient uptake by plants, and micronutrients play a pivotal role in maintaining soil fertility. Recent studies indicate that soils deficient in micronutrients can lead to reduced crop yields and lower quality produce. As farmers become increasingly aware of the importance of soil health, the demand for micronutrient products is expected to rise. This trend is further supported by government initiatives promoting sustainable farming practices and soil conservation. The Crop Micronutrient Market is likely to see growth as stakeholders recognize the value of investing in soil health to enhance agricultural output and sustainability.

Government Support and Subsidies

Government support and subsidies play a crucial role in shaping the Crop Micronutrient Market. Many governments are recognizing the importance of micronutrients in enhancing agricultural productivity and food security. As a result, various initiatives and financial incentives are being introduced to encourage farmers to utilize micronutrient products. These programs aim to improve crop yields and promote sustainable agricultural practices. Recent reports indicate that countries investing in agricultural subsidies are witnessing a positive impact on their agricultural output. This support not only alleviates the financial burden on farmers but also fosters innovation within the Crop Micronutrient Market. Consequently, the combination of government backing and farmer adoption is likely to drive growth in the sector.

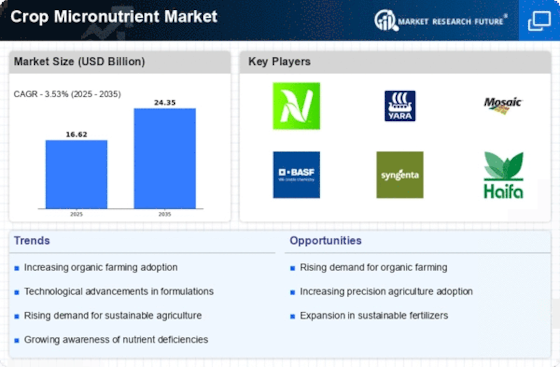

Emerging Trends in Organic Farming

The rise of organic farming is significantly impacting the Crop Micronutrient Market. As consumers increasingly prefer organic produce, farmers are adapting their practices to meet this demand. Organic farming often emphasizes the use of natural micronutrient sources, which can enhance soil fertility and crop health. This shift towards organic methods is likely to drive the demand for micronutrient products that comply with organic standards. Market analysis indicates that the organic farming sector is expanding rapidly, which may lead to increased opportunities for micronutrient suppliers. The Crop Micronutrient Market is thus poised to benefit from this trend, as farmers seek to improve their organic crop yields while adhering to sustainable practices.

Rising Adoption of Precision Agriculture

The Crop Micronutrient Market is experiencing a notable shift towards precision agriculture, which utilizes advanced technologies to optimize crop production. This approach allows farmers to apply micronutrients more efficiently, ensuring that crops receive the exact nutrients they require. As a result, the demand for specialized micronutrient products is likely to increase. According to recent data, the precision agriculture market is projected to grow significantly, which may drive the adoption of micronutrient solutions tailored for specific crop needs. This trend not only enhances yield but also promotes sustainable farming practices, aligning with the broader goals of environmental stewardship. Consequently, the Crop Micronutrient Market stands to benefit from this technological evolution, as farmers seek to maximize productivity while minimizing resource waste.

Increasing Consumer Demand for Nutrient-Rich Food

The rising consumer demand for nutrient-rich food is significantly influencing the Crop Micronutrient Market. As health-conscious consumers seek foods that provide essential vitamins and minerals, farmers are compelled to enhance the nutritional profile of their crops. This shift has led to an increased focus on the application of micronutrients, which are vital for plant growth and development. Market data suggests that the demand for fortified crops is on the rise, prompting agricultural producers to invest in micronutrient solutions. This trend not only benefits consumers but also encourages farmers to adopt practices that improve crop quality. The Crop Micronutrient Market is thus positioned to grow as it aligns with the evolving preferences of consumers for healthier food options.