Rising Threat Landscape

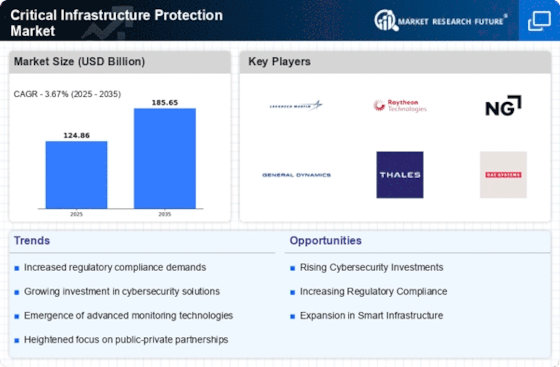

The increasing complexity and frequency of cyber threats are driving the Critical Infrastructure Protection Market. Organizations are facing sophisticated attacks that target critical infrastructure, including energy, transportation, and water systems. According to recent assessments, the number of reported cyber incidents has surged, prompting governments and private entities to invest heavily in protective measures. This trend indicates a growing recognition of the vulnerabilities inherent in critical infrastructure, leading to a projected market growth rate of approximately 10% annually. As threats evolve, the demand for advanced security solutions becomes paramount, thereby propelling the Critical Infrastructure Protection Market forward.

Technological Advancements

Technological advancements are playing a pivotal role in transforming the Critical Infrastructure Protection Market. Innovations such as artificial intelligence, machine learning, and the Internet of Things are being integrated into security frameworks, enhancing the ability to detect and respond to threats in real-time. The market for these technologies is expected to grow significantly, with estimates suggesting a compound annual growth rate of 12% over the next five years. As organizations seek to leverage these advancements, the Critical Infrastructure Protection Market is poised for substantial growth, driven by the demand for more sophisticated and effective security solutions.

Public-Private Partnerships

The emergence of public-private partnerships is reshaping the landscape of the Critical Infrastructure Protection Market. These collaborations enable the sharing of resources, expertise, and information between government entities and private organizations. By pooling their strengths, stakeholders can develop more robust security strategies that address the unique challenges faced by critical infrastructure. Recent studies suggest that such partnerships have led to a 15% increase in the effectiveness of security measures implemented across various sectors. As the need for comprehensive protection grows, the Critical Infrastructure Protection Market is likely to see a rise in collaborative efforts that enhance overall security posture.

Increased Regulatory Pressure

The rise in regulatory pressure surrounding critical infrastructure security is a key driver for the Critical Infrastructure Protection Market. Governments are implementing stricter regulations and compliance requirements to ensure the safety and resilience of essential services. Recent legislative measures have introduced mandatory cybersecurity standards for critical sectors, compelling organizations to invest in protective technologies. This regulatory landscape is expected to create a market environment where compliance becomes a primary driver of investment in security solutions. As organizations strive to meet these requirements, the Critical Infrastructure Protection Market is likely to experience accelerated growth, reflecting the urgency of addressing regulatory challenges.

Government Initiatives and Funding

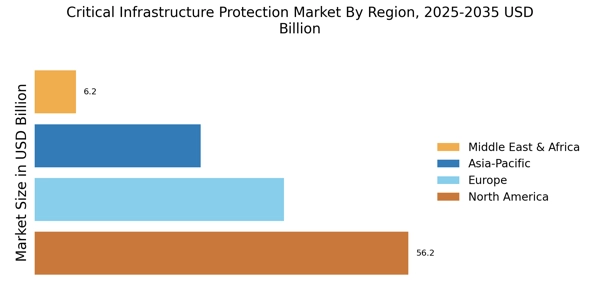

Government initiatives aimed at enhancing national security are significantly influencing the Critical Infrastructure Protection Market. Various countries are allocating substantial budgets to bolster the security of critical infrastructure sectors. For instance, recent reports indicate that federal funding for cybersecurity initiatives has increased by over 20% in the last fiscal year. This financial support is often directed towards developing new technologies and frameworks that ensure the resilience of critical infrastructure. Consequently, the Critical Infrastructure Protection Market is likely to benefit from these investments, as they facilitate the adoption of innovative security solutions and promote collaboration between public and private sectors.