Expansion of Automotive Production

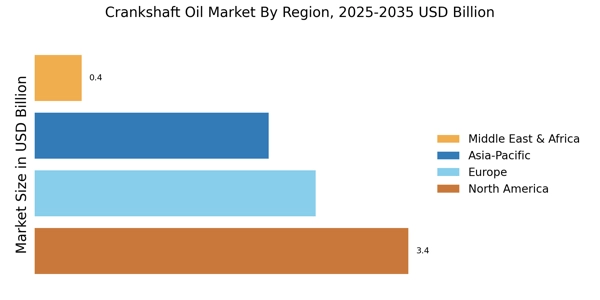

The Crankshaft Oil Market is poised to benefit from the ongoing expansion of automotive production across various regions. As economies recover and consumer confidence rises, automotive manufacturers are ramping up production to meet the increasing demand for vehicles. This expansion is expected to lead to a higher consumption of crankshaft oils, as each vehicle requires specific formulations to ensure optimal engine performance. Recent statistics indicate that automotive production is anticipated to reach over 100 million units annually in the coming years. This growth in production not only stimulates the demand for crankshaft oils but also encourages innovation within the industry, as manufacturers strive to develop oils that enhance engine longevity and efficiency.

Regulatory Standards and Compliance

The Crankshaft Oil Market is significantly influenced by stringent regulatory standards and compliance requirements imposed by various governing bodies. These regulations often mandate the use of specific oil formulations that meet environmental and performance criteria. As a result, manufacturers are increasingly investing in research and development to create oils that comply with these regulations while also delivering superior performance. The introduction of new standards, such as those related to emissions and fuel efficiency, is likely to reshape the market landscape. This focus on compliance not only drives innovation but also enhances the overall quality of crankshaft oils available in the market, thereby benefiting consumers and manufacturers alike.

Rising Awareness of Engine Maintenance

The Crankshaft Oil Market is benefiting from a growing awareness among consumers regarding the importance of engine maintenance. As vehicle owners become more informed about the role of quality oils in prolonging engine life and enhancing performance, the demand for premium crankshaft oils is expected to rise. Educational campaigns and information dissemination by manufacturers and automotive experts are contributing to this trend. Recent surveys indicate that a significant percentage of consumers are willing to invest in higher-quality oils to ensure their vehicles operate efficiently. This heightened awareness is likely to drive sales in the Crankshaft Oil Market, as consumers prioritize engine health and longevity.

Technological Innovations in Oil Production

The Crankshaft Oil Market is witnessing a wave of technological innovations that are transforming oil production processes. Advances in refining techniques and the development of synthetic oils are enabling manufacturers to produce higher-quality crankshaft oils that offer improved performance and protection. These innovations are particularly relevant as engines become more complex and demanding. For instance, the introduction of advanced additives and formulations can significantly enhance the oil's ability to withstand extreme conditions. As a result, the market is likely to see a shift towards oils that not only meet but exceed current performance standards, thereby attracting a broader consumer base and driving growth in the Crankshaft Oil Market.

Increasing Demand for High-Performance Engines

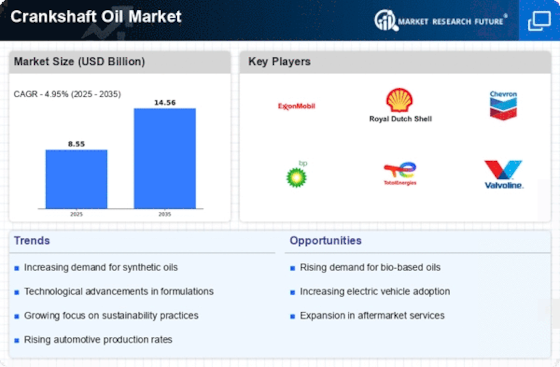

The Crankshaft Oil Market is experiencing a notable surge in demand for high-performance engines, particularly in the automotive sector. As consumers increasingly seek vehicles that offer enhanced power and efficiency, manufacturers are compelled to develop engines that can withstand higher stress and temperatures. This trend necessitates the use of specialized crankshaft oils that provide superior lubrication and protection. According to recent data, the market for high-performance engine oils is projected to grow at a compound annual growth rate of approximately 5% over the next few years. Consequently, this growing demand for high-performance engines is likely to drive the Crankshaft Oil Market, as manufacturers adapt their products to meet these evolving requirements.