Growing Geriatric Population

The Crack Tooth Syndrome Market is significantly impacted by the growing geriatric population, which is more susceptible to dental issues, including crack tooth syndrome. As individuals age, the risk of dental problems increases due to factors such as wear and tear, decreased saliva production, and underlying health conditions. Current demographic trends indicate that the population aged 65 and older is expected to double by 2050, leading to a higher demand for dental care services. This demographic shift is likely to drive the Crack Tooth Syndrome Market, as dental professionals adapt their services to meet the needs of an aging population.

Rising Incidence of Dental Disorders

The Crack Tooth Syndrome Market is influenced by the rising incidence of dental disorders, which has been steadily increasing over the years. Factors such as dietary changes, increased consumption of sugary foods, and a lack of proper oral hygiene contribute to this trend. Recent statistics indicate that approximately 30% of adults experience some form of dental issue, with crack tooth syndrome being a prevalent concern. This growing prevalence necessitates enhanced dental care services and products, thereby propelling the Crack Tooth Syndrome Market forward. As awareness of dental health continues to rise, the demand for specialized treatments is expected to grow.

Expansion of Dental Insurance Coverage

The Crack Tooth Syndrome Market is benefiting from the expansion of dental insurance coverage, which is making dental care more accessible to a broader population. As insurance providers increasingly recognize the importance of preventive and restorative dental care, more individuals are seeking treatment for conditions like crack tooth syndrome. Recent reports indicate that dental insurance enrollment has increased by 20% over the past five years, facilitating access to necessary treatments. This trend is expected to continue, potentially leading to a surge in demand for services within the Crack Tooth Syndrome Market, as more patients are able to afford comprehensive dental care.

Increased Focus on Aesthetic Dentistry

The Crack Tooth Syndrome Market is also being driven by an increased focus on aesthetic dentistry. Patients are becoming more conscious of their dental appearance, leading to a higher demand for cosmetic procedures that address issues like cracked teeth. The integration of aesthetic considerations into dental treatments has prompted practitioners to seek advanced solutions that not only restore function but also enhance visual appeal. Market data suggests that the aesthetic dentistry segment is projected to grow by 15% annually, reflecting the rising consumer preference for treatments that combine functionality with aesthetics. This trend is likely to further stimulate the Crack Tooth Syndrome Market.

Technological Advancements in Treatment

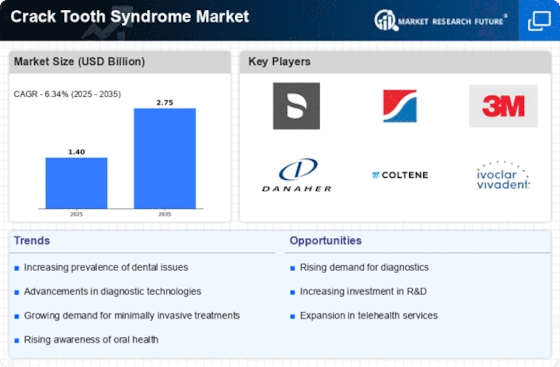

The Crack Tooth Syndrome Market is experiencing a notable transformation due to advancements in dental technology. Innovations such as 3D imaging and digital scanning have enhanced diagnostic accuracy, allowing for earlier detection of crack tooth syndrome. Furthermore, the development of minimally invasive treatment options, including adhesive dentistry and advanced restorative materials, has improved patient outcomes. According to recent data, the adoption of these technologies has led to a 25% increase in successful treatment rates. As dental professionals increasingly embrace these innovations, the Crack Tooth Syndrome Market is likely to expand, driven by the demand for effective and efficient treatment solutions.

Leave a Comment