Corporate E Learning Size

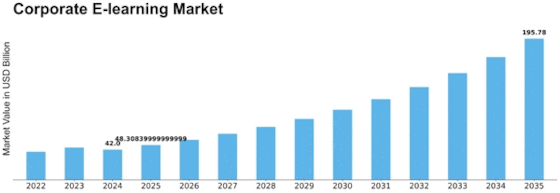

Corporate E-learning Market Growth Projections and Opportunities

The fast rise in the number of workers getting training and development chances at work has an impact on the business e-learning industry's growth path. An increasing number of companies understand that their workers need to improve their skills to stay ahead in a market that is always changing. This has led to a huge increase in the need for corporate e-learning options. Technological progress has always been and will always be the most important part of the e-learning industry's success.

Modern technologies like virtual reality, augmented reality, and artificial intelligence are helping to improve the old ways of teaching. These tools make it possible to have learning experiences that are very active and interesting. As companies quickly adopt new technologies to make their training and education more effective, e-learning options for businesses are growing in popularity. Because of the changing nature of work, which includes teams that work from different places, the need for business e-learning options has grown. Remote work and the job economy are becoming more and more popular.

As a result, companies are looking for training options that are open and easy to access so they can meet the needs and demands of all their employees. E-learning systems let employees study whenever and wherever it's convenient for them. This means that they can learn new skills at their own pace and when it's most convenient for them. The low cost of business e-learning tools is one reason why they are becoming more popular. Venue fees, journey costs, and the cost of written papers are some of the costs that come with standard training methods. Using a digital tool for teaching, e-learning gets rid of these costs. Companies might be able to cut their training costs by a large amount while still giving their employees high-quality, thought-provoking learning chances. The need to follow rules and guidelines in the business world is another thing that is making the company e-learning market grow.

E-learning systems make training organized and easy to check, which is important in fields like healthcare, banking, and manufacturing where following rules is important. This helps make sure that everyone knows the rules for following them, which lowers the chances of breaking the rules and the punishments that come with it. There are a lot of solution companies that offer unique material and services. This makes the business e-learning market more competitive. Businesses are looking for e-learning partners that can offer customizable solutions as the need for specialized and industry-specific training packages grows. Because of this, there is more competition between companies that offer e-learning services. This has led to new ideas and the creation of specialized content to meet the needs of certain industries.

Leave a Comment