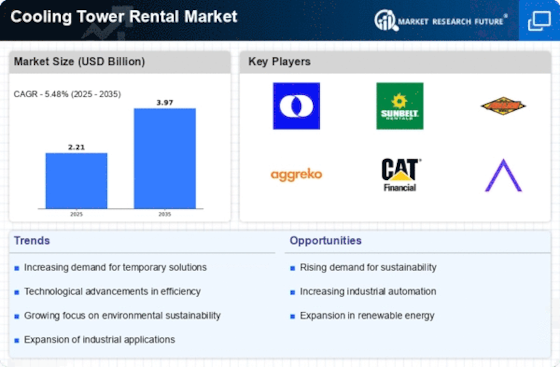

Rising Industrial Activities

The Cooling Tower Rental Market is experiencing a surge in demand due to increasing industrial activities across various sectors. Industries such as manufacturing, oil and gas, and power generation are expanding, necessitating temporary cooling solutions to manage heat loads effectively. This trend is particularly evident in regions where new facilities are being established, leading to a projected growth rate of approximately 5% annually in the rental segment. As companies seek to optimize operational efficiency without committing to long-term investments, the rental model offers a flexible and cost-effective alternative. Consequently, the Cooling Tower Rental Market is poised to benefit from this industrial expansion, as businesses increasingly turn to rental solutions to meet their cooling needs.

Seasonal Demand Fluctuations

The Cooling Tower Rental Market is characterized by seasonal demand fluctuations, particularly in regions with extreme temperature variations. During peak summer months, industries such as construction and agriculture require additional cooling capacity to manage increased heat loads. This seasonal spike in demand for rental cooling towers presents a unique opportunity for rental companies to capitalize on short-term contracts. Data suggests that rental demand can increase by as much as 30% during peak seasons, highlighting the importance of flexibility in rental agreements. As businesses seek to avoid the high costs associated with purchasing cooling equipment, the rental model provides a viable solution. Thus, the Cooling Tower Rental Market is likely to see sustained growth driven by these seasonal trends.

Cost-Effectiveness of Rental Solutions

The Cooling Tower Rental Market is significantly influenced by the cost-effectiveness of rental solutions compared to outright purchases. Many businesses face budget constraints and prefer to allocate resources to core operations rather than capital expenditures on cooling equipment. Renting cooling towers allows companies to access high-quality equipment without the burden of maintenance and storage costs associated with ownership. This financial flexibility is particularly appealing to small and medium-sized enterprises that may not have the capital to invest in permanent cooling solutions. As a result, the rental model is gaining traction, with a projected increase in market share as more businesses recognize the economic advantages. The Cooling Tower Rental Market is thus likely to expand as cost-conscious companies opt for rental solutions to meet their cooling needs.

Technological Innovations in Cooling Solutions

The Cooling Tower Rental Market is benefiting from rapid technological innovations that enhance the efficiency and performance of cooling systems. Advancements in materials, design, and control systems are leading to the development of more efficient cooling towers that consume less energy and provide better cooling performance. As industries become more aware of the benefits of these innovations, there is a growing inclination to rent rather than purchase outdated equipment. The integration of smart technologies, such as IoT-enabled monitoring systems, allows for real-time performance tracking and optimization, further driving the appeal of rental solutions. This trend suggests that the Cooling Tower Rental Market will continue to evolve, with companies increasingly seeking technologically advanced rental options to meet their cooling requirements.

Regulatory Compliance and Environmental Standards

The Cooling Tower Rental Market is influenced by stringent regulatory compliance and environmental standards that govern industrial operations. As governments implement more rigorous regulations regarding emissions and energy consumption, companies are compelled to adopt efficient cooling solutions. Rental cooling towers, which often feature advanced technologies that minimize environmental impact, are becoming a preferred choice. This shift is driven by the need to comply with regulations while maintaining operational efficiency. The market is projected to grow as industries prioritize sustainable practices, with a notable increase in demand for rental solutions that align with environmental standards. This trend indicates a significant opportunity for the Cooling Tower Rental Market to expand its offerings in response to regulatory pressures.