Increased Focus on User Experience

In the Content Distribution Software Market, there is an increased focus on user experience as organizations recognize its critical role in content engagement. Companies are striving to create intuitive and user-friendly interfaces that facilitate seamless content distribution across various platforms. Research indicates that enhancing user experience can lead to a 25% increase in user retention rates. This trend is prompting software developers to prioritize usability in their design processes, ensuring that users can easily navigate and utilize the tools available to them. As the competition intensifies, organizations that invest in improving user experience are likely to gain a competitive edge, making this focus a key driver in the evolution of the content distribution software market.

Shift Towards Subscription-Based Models

The Content Distribution Software Market is experiencing a shift towards subscription-based models, which are becoming increasingly popular among businesses seeking flexibility and cost-effectiveness. This trend is indicative of a broader movement within the software industry, where organizations prefer to pay for services on a subscription basis rather than incurring large upfront costs. Data suggests that subscription-based models can lead to a 30% reduction in overall software expenses for companies. This shift not only allows for easier budgeting but also enables organizations to access the latest features and updates without additional costs. As more companies adopt this model, content distribution software providers are likely to adapt their pricing strategies to remain competitive, thereby reshaping the market landscape.

Emergence of Data-Driven Decision Making

In the Content Distribution Software Market, the emergence of data-driven decision making is reshaping how organizations approach content distribution. Businesses are increasingly leveraging analytics to understand audience behavior and preferences, which in turn informs their content strategies. This trend is supported by the fact that companies utilizing data analytics report a 20% increase in engagement rates. As organizations strive to create more targeted and relevant content, the demand for software that can analyze and interpret data effectively is surging. This shift towards data-centric approaches not only enhances the efficiency of content distribution but also allows for more personalized user experiences. Consequently, the integration of advanced analytics tools within content distribution software is becoming a critical factor for success in the industry.

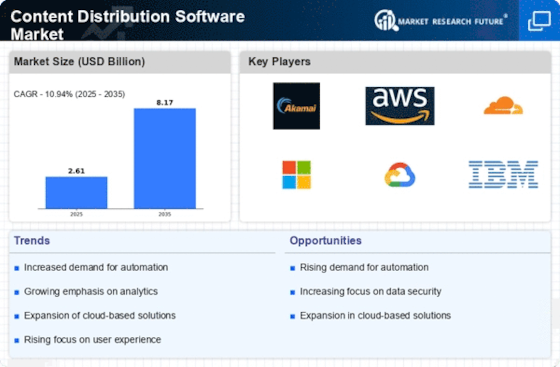

Rising Demand for Efficient Content Delivery

The Content Distribution Software Market is experiencing a notable rise in demand for efficient content delivery solutions. As organizations increasingly rely on digital platforms to disseminate information, the need for software that can optimize content distribution becomes paramount. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is driven by the necessity for businesses to enhance their online presence and engage audiences effectively. Companies are seeking tools that not only streamline the distribution process but also ensure that content reaches the right audience at the right time. This trend indicates a shift towards more sophisticated content management systems that can handle diverse formats and channels, thereby enhancing user experience and engagement.

Growing Importance of Security and Compliance

The Content Distribution Software Market is witnessing a growing emphasis on security and compliance as organizations become increasingly aware of the risks associated with digital content distribution. With the rise of data breaches and stringent regulations, businesses are prioritizing software solutions that offer robust security features. Recent statistics indicate that nearly 60% of companies consider security a top priority when selecting content distribution tools. This trend underscores the necessity for software that not only facilitates efficient content delivery but also ensures compliance with data protection regulations. As a result, vendors are focusing on enhancing their offerings with advanced security protocols, thereby fostering trust and reliability among users. This heightened focus on security is likely to drive innovation within the industry, as companies seek to balance efficiency with the need for stringent compliance measures.