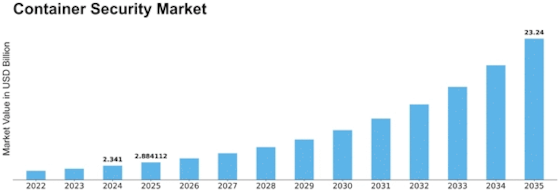

Container Security Size

Container Security Market Growth Projections and Opportunities

The small yet competitive Container Security market has a number of factors that have caused it to grow significantly and diversify in the last few years. As more enterprises forego the use of virtual machines in favor of container technology, which lets them conveniently maintain and manage their software application deployment, robust security priorities have become irrefutable. Container security is a set of tools including methods, which is a security practice for containers that safeguard applications and the infrastructure that is behind. Market condition for the Container Security market system is affected by several key elements.

Containers have wide application in the market with the prevailing issue of container vulnerabilities and the rise of container security risks being the driving factor. Containers ensure the fact that applications function in an environment that is light weight and scalable but at the same time, they introduce unique security concerns. Weaknesses like improper configurations, unsecured container images, and inadequate communication employee give the attackers a way to gain access to the systems and steal information. These overwhelming numbers of new vulnerabilities thwart organizations that specialize in containers becoming more and more critical to apply efficient solutions for containers security.

Apart from the aforementioned factors that impact the Container Security Market, the increasing embrace of the DevOps and container orchestration technologies, including Kubernetes, are other critical domains. DevOps principles highlighting the merging of development and operation professionals as a way of accelerating development time and bettering teamwork is one of the elements of this process. Auto-containers and orchestrator systems solve the issue of resource and application management by helping companies to run containerize the applications efficiently. On one hand, immediate portability and seamless merger of units raise the security as a condition if they are not properly handled. A range of functions such as container vulnerability scanning, runtime protection, and access control fall within the purview of security solutions for containers when applied in DevOps or container hosting environment.

Moreover, it is becoming more and more evident that the market structure in Container Security market is being created by amplified regulatory compliance requirements. All industries have to comply with different regulations and Data Protection Acts, of the order of of GDPR and PCI DSS. Such regulatory instruments impose a duty of protecting sensitive data, while requiring the implementation of relevant security procedures. Solutions for container security compliance assist organizations with meeting the compliance provisions through functions such as encryption, access control and audit trails. Given the fact that data protection regulations are required to be followed, it is that which is driving the adoption of container-oriented security solutions.

Leave a Comment