Rising Repair Costs

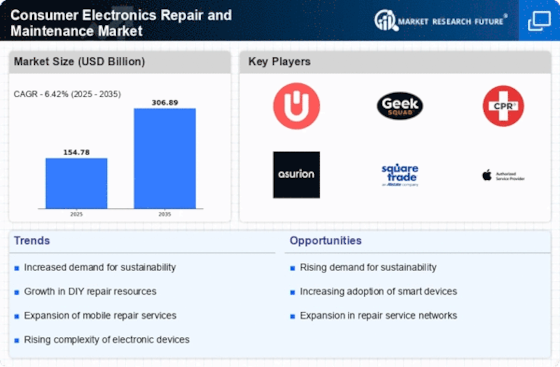

The increasing costs associated with purchasing new consumer electronics appear to be a significant driver for the consumer electronics repair and maintenance Market. As consumers face higher prices for devices, they may opt for repair services instead of replacement. Data indicates that the average cost of a new smartphone has risen by approximately 20% over the past three years, prompting consumers to seek more economical solutions. This trend suggests a growing preference for repair services, as individuals aim to extend the lifespan of their existing devices. Consequently, the Consumer Electronics Repair and Maintenance Market is likely to experience heightened demand as consumers prioritize cost-effective alternatives to new purchases.

Environmental Regulations

The implementation of stringent environmental regulations is influencing the Consumer Electronics Repair and Maintenance Market. Governments are increasingly mandating recycling and waste reduction initiatives, which encourage consumers to repair rather than discard their electronics. For instance, regulations that promote the circular economy are gaining traction, compelling manufacturers to design products that are easier to repair. This shift not only aligns with sustainability goals but also fosters a culture of repair among consumers. As a result, the Consumer Electronics Repair and Maintenance Market is poised for growth, driven by the need to comply with these evolving regulations and the public's growing environmental consciousness.

Increased Device Lifespan

The trend towards longer-lasting consumer electronics is contributing to the growth of the Consumer Electronics Repair and Maintenance Market. Manufacturers are increasingly focusing on durability and repairability in their designs, resulting in devices that can withstand wear and tear over extended periods. This shift is evident in the smartphone market, where the average lifespan of devices has increased from two years to nearly three years. As consumers hold onto their devices longer, the demand for repair services is expected to rise, as users seek to maintain and upgrade their existing electronics rather than purchasing new ones. This trend indicates a promising outlook for the Consumer Electronics Repair and Maintenance Market.

Technological Advancements

Technological advancements in repair techniques and tools are reshaping the Consumer Electronics Repair and Maintenance Market. Innovations such as augmented reality and artificial intelligence are enhancing the efficiency and accuracy of repair processes. For example, AI-driven diagnostic tools can quickly identify issues in devices, reducing repair time and costs. Furthermore, the proliferation of online repair tutorials and resources empowers consumers to undertake repairs themselves, thereby expanding the market. As technology continues to evolve, the Consumer Electronics Repair and Maintenance Market is likely to benefit from these advancements, which facilitate easier and more effective repair solutions.

Consumer Awareness and Education

Growing consumer awareness regarding the benefits of repair over replacement is driving the Consumer Electronics Repair and Maintenance Market. Educational campaigns and advocacy for repair rights are fostering a culture that values sustainability and resourcefulness. As consumers become more informed about the environmental impact of electronic waste, they are more likely to seek repair services. Surveys indicate that a significant percentage of consumers now prefer to repair their devices rather than discard them, reflecting a shift in mindset. This heightened awareness is likely to sustain the demand for repair services, positioning the Consumer Electronics Repair and Maintenance Market for continued growth.