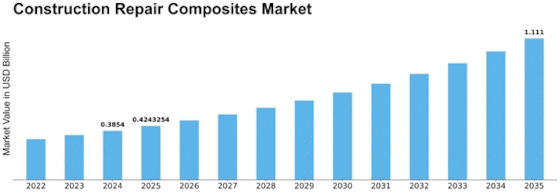

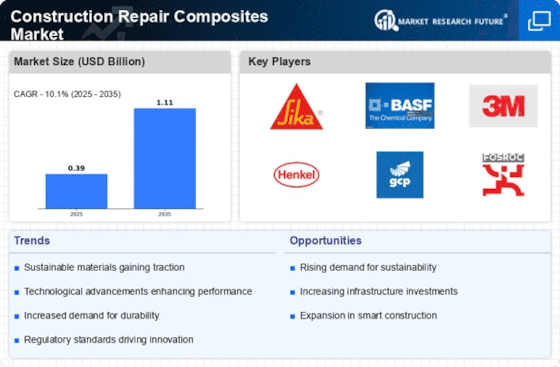

Construction Repair Composites Size

Construction Repair Composites Market Growth Projections and Opportunities

The Construction Repair Composites market is influenced by various factors that play a crucial role in its growth and development. To gain insights into the dynamics of this industry, it's essential to explore the critical market factors shaping the Construction Repair Composites market. Here are key factors presented in a clear and concise pointer format: Infrastructure Aging and Rehabilitation: The demand for construction repair composites is driven by the aging infrastructure in many regions. As buildings, bridges, and other structures deteriorate over time, repair composites offer a cost-effective and durable solution for extending the lifespan and structural integrity of these assets. Increasing Focus on Sustainable Solutions: Construction repair composites are often preferred for their sustainability benefits. With a growing emphasis on environmentally friendly construction practices, repair composites that reduce the need for demolitions, minimize waste, and provide long-lasting repairs are gaining traction in the market. High Strength and Durability Requirements: The construction industry demands materials that can withstand high stress, weathering, and other environmental factors. Construction repair composites, known for their high strength and durability, are favored for applications where traditional materials may fall short in meeting stringent performance requirements. Corrosion Protection in Infrastructure: Corrosion is a significant concern for infrastructure exposed to harsh environmental conditions. Construction repair composites provide an effective solution for corrosion protection, extending the life of structures and reducing the frequency of maintenance and repairs. Technological Advancements in Composite Materials: Ongoing advancements in composite materials technology contribute to the growth of the construction repair composites market. Innovations in resin formulations, fiber reinforcements, and manufacturing processes enhance the performance and versatility of these materials, expanding their applications. Government Investments in Infrastructure: Government initiatives and investments in infrastructure development projects influence the demand for construction repair composites. Rehabilitation and repair activities funded by government bodies contribute to the market's expansion, particularly in regions with aging infrastructure. Rising Urbanization and Population Growth: The global trend of urbanization and population growth increases the strain on existing infrastructure. Construction repair composites play a crucial role in maintaining and upgrading urban structures, addressing the challenges posed by increased usage and environmental factors. Adoption in Seismic Retrofitting: Construction repair composites find applications in seismic retrofitting projects. In earthquake-prone regions, these composites are used to strengthen and reinforce structures, improving their resilience to seismic events and ensuring the safety of occupants. Cost-Efficiency Compared to Traditional Methods: Construction repair composites offer cost-efficient solutions compared to traditional repair methods. The reduced labor, downtime, and material waste associated with composite repairs contribute to their cost-effectiveness, making them an attractive option for budget-conscious construction projects. Contractor and Engineer Awareness and Training: The awareness and training of contractors and engineers play a crucial role in the adoption of construction repair composites. Education and training programs that highlight the benefits, applications, and proper installation techniques contribute to the successful integration of these composites in construction projects.

Leave a Comment