North America : Market Leader in Power Tools

North America is poised to maintain its leadership in the Construction Power Tools Repair and Maintenance Services Market, holding a significant market size of $9.1 billion. The region's growth is driven by robust construction activities, increasing demand for power tools, and stringent safety regulations. The emphasis on sustainability and efficiency in construction practices further propels the market forward, with a projected growth rate of 5% annually.

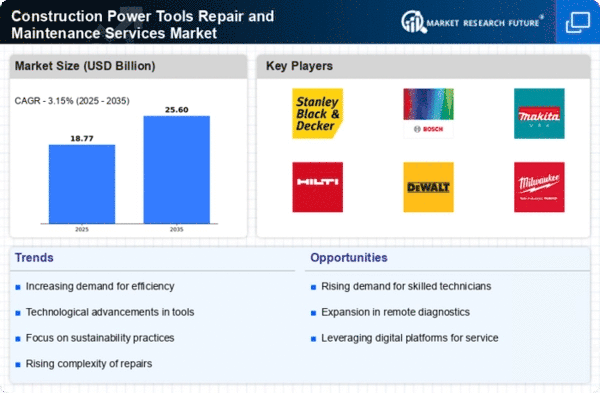

The competitive landscape is characterized by major players such as Stanley Black & Decker, DeWalt, and Milwaukee Tool, which dominate the market with innovative service offerings. The U.S. and Canada are the leading countries, benefiting from advanced infrastructure and a high level of investment in construction projects. The presence of established brands ensures a steady demand for repair and maintenance services, solidifying North America's market position.

Europe : Emerging Market Dynamics

Europe's Construction Power Tools Repair and Maintenance Services Market is valued at $5.5 billion, reflecting a growing demand driven by increasing construction activities and a focus on sustainability. Regulatory frameworks promoting energy efficiency and safety standards are key growth catalysts. The market is expected to expand as more companies invest in maintenance services to prolong the lifespan of their tools, with a growth rate of approximately 4% projected.

Leading countries in this region include Germany, France, and the UK, where major players like Bosch and Festool are well-established. The competitive landscape is marked by innovation and a focus on customer service, with companies adapting to the evolving needs of the construction sector. The presence of strong regulatory bodies ensures compliance and quality in service delivery, enhancing market stability.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region, with a market size of $2.9 billion, is witnessing rapid growth in the Construction Power Tools Repair and Maintenance Services Market. This growth is fueled by urbanization, increasing infrastructure projects, and a rising demand for advanced power tools. Countries like China and India are leading this trend, supported by government initiatives aimed at enhancing construction capabilities and safety standards. The market is projected to grow at a rate of 6% annually as investments in construction surge.

China stands out as a key player, with significant contributions from local manufacturers and international brands like Makita and Hitachi Koki. The competitive landscape is evolving, with a mix of established companies and emerging players vying for market share. The focus on quality and service efficiency is paramount, as companies adapt to the growing needs of the construction industry in this dynamic region.

Middle East and Africa : Emerging Opportunities

The Middle East and Africa region, with a market size of $0.7 billion, is gradually emerging in the Construction Power Tools Repair and Maintenance Services Market. The growth is driven by increasing construction activities, particularly in the Gulf Cooperation Council (GCC) countries, where infrastructure development is a priority. Regulatory support for safety and quality standards is also enhancing market prospects, with a growth rate of around 3% expected in the coming years.

Leading countries in this region include the UAE and South Africa, where investments in construction are on the rise. The competitive landscape is characterized by a mix of local and international players, with companies focusing on service quality and customer satisfaction. The presence of key players is growing, as they adapt to the unique challenges and opportunities presented in this diverse market.