Market Share

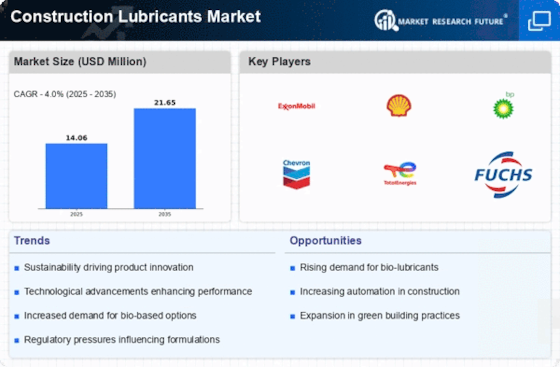

Construction Lubricants Market Share Analysis

In the competitive Construction Lubricants Market, market share positioning tactics determine company success. To achieve market share, these tactics use numerous methods to stand out from competition. Companies often differentiate their lubricants by offering features or compositions that meet construction equipment needs. This attracts specialist markets and builds a brand as an industry innovator.

Market share positioning also depends on price strategies. Some organizations use competitive pricing to gain market share, especially when entering new markets or offering new products. Others may use premium pricing to target customers who value performance and dependability over cost by offering high-quality lubricants with extra value. Sustainable market share expansion requires balancing pricing and product quality.

Distribution networks are crucial to market positioning. Strong distribution networks make products available to customers, giving companies with efficient operations and vast reach an edge. Collaboration with key distributors and retailers helps boost market share by increasing visibility and accessibility.

Market share positioning also requires marketing and brand-building. Effective branding through advertising, sponsorships, and promotions can change client preferences. Lubricants with special selling points like environmental friendliness, long-lasting performance, or compatibility with current construction equipment are widely marketed.

Strategic agreements and collaborations also affect Construction Lubricants Market share. OEM partnerships or strategic alliances with construction industry leaders can expand market reach. Co-branded products or exclusive supply agreements can give companies a competitive edge and market share.

Additionally, customer service and assistance can boost market share. Good after-sales service, technical assistance, and product training can generate client loyalty and repeat business. Happy customers are more inclined to recommend products, increasing market share and word-of-mouth marketing.

Finally, modifying market share positioning strategies requires monitoring market developments and new technology. New technologies like IoT and sustainability are changing the construction business. Lubricant companies that follow these trends might seize market opportunities and acquire a competitive edge.

Finally, construction lubricants market share positioning requires product differentiation, pricing strategies, distribution channels, marketing, strategic partnerships, customer service, and adaptability to industry trends. Companies that successfully follow these tactics can increase market share and become leaders in the dynamic and competitive construction lubricant market.

Leave a Comment