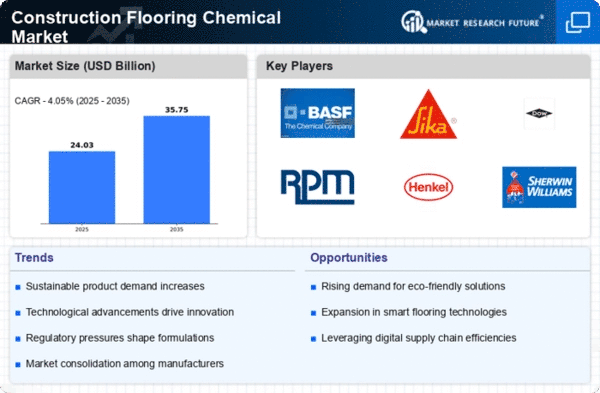

The Construction Flooring Chemical Market is currently characterized by a dynamic competitive landscape, driven by increasing demand for durable and sustainable flooring solutions. Key players are actively engaging in strategies that emphasize innovation, regional expansion, and partnerships to enhance their market presence. For instance, BASF SE (DE) has been focusing on developing eco-friendly flooring solutions, which aligns with the growing trend towards sustainability. Similarly, Sika AG (CH) is leveraging its strong R&D capabilities to introduce advanced flooring systems that cater to diverse customer needs, thereby solidifying its competitive edge.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies like The Dow Chemical Company (US) and RPM International Inc. (US) is significant, as they continue to innovate and expand their product offerings, thereby shaping the overall market structure.

In November The Dow Chemical Company (US) announced the launch of a new line of high-performance flooring adhesives designed for industrial applications. This strategic move is likely to enhance their product portfolio and cater to the growing demand for robust flooring solutions in various sectors. The introduction of these adhesives not only reflects Dow's commitment to innovation but also positions them favorably against competitors in the market.

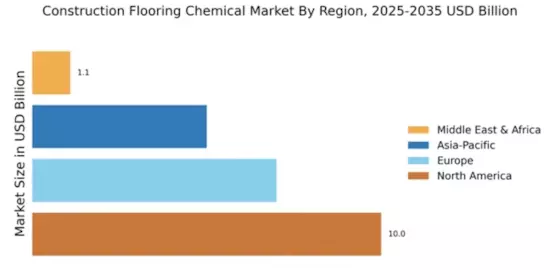

In October RPM International Inc. (US) completed the acquisition of a regional flooring chemical manufacturer, which is expected to bolster its market presence in North America. This acquisition is strategically important as it allows RPM to expand its distribution network and enhance its product offerings, thereby increasing its competitive advantage in the region. Such consolidation efforts indicate a trend towards greater market concentration among key players.

In September Henkel AG & Co. KGaA (DE) launched a new digital platform aimed at streamlining customer interactions and enhancing service delivery in the flooring sector. This initiative underscores the growing importance of digital transformation in the industry, as companies seek to improve customer engagement and operational efficiency. By investing in digital solutions, Henkel is likely positioning itself as a forward-thinking leader in the market.

As of December current competitive trends indicate a strong emphasis on digitalization, sustainability, and the integration of AI technologies within the Construction Flooring Chemical Market. Strategic alliances are increasingly shaping the landscape, as companies collaborate to leverage complementary strengths. Moving forward, competitive differentiation is expected to evolve, with a shift from price-based competition towards innovation, technology, and supply chain reliability. This transition suggests that companies that prioritize R&D and sustainable practices will likely emerge as leaders in the market.