Market Analysis

In-depth Analysis of Construction Fabrics Market Industry Landscape

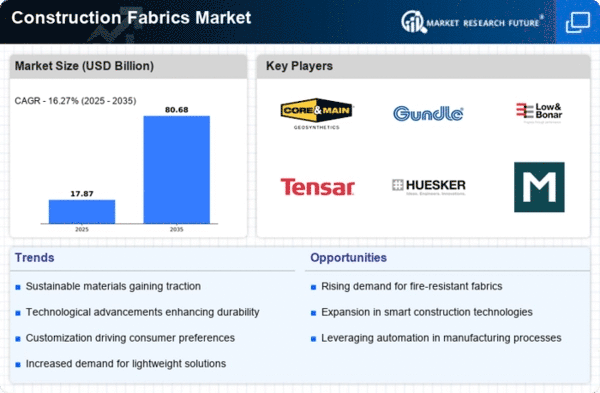

The Construction Fabrics Market operates within a dynamic landscape influenced by a multitude of factors that collectively shape its growth and trends. Construction fabrics, comprising materials such as geotextiles, geomembranes, and shade fabrics, find extensive applications in the construction and infrastructure sectors. The market dynamics of construction fabrics are intricately linked to trends in civil engineering projects, technological advancements, environmental considerations, and global economic conditions.

A significant driver of the construction fabrics market is the demand from civil engineering and infrastructure projects. Geotextiles, for example, are widely used for soil stabilization, erosion control, and drainage applications in road construction and geotechnical engineering. The dynamics of the construction fabrics market respond to the increasing focus on sustainable and cost-effective solutions in civil engineering, with fabric materials proving crucial in enhancing the performance and longevity of infrastructure projects.

Technological advancements play a pivotal role in shaping the construction fabrics market dynamics. Ongoing research and development efforts focus on improving the strength, durability, and functionality of construction fabrics. Innovations in manufacturing processes and the development of advanced coating technologies contribute to the production of high-performance fabrics that meet the diverse needs of construction projects. The market dynamics adapt to these technological breakthroughs, with companies striving to provide innovative fabric solutions for evolving engineering challenges.

Environmental considerations are increasingly influencing the construction fabrics market dynamics. As sustainability becomes a key driver in construction practices, the market responds with a growing emphasis on eco-friendly fabric materials. Geotextiles and other construction fabrics designed for permeability, water conservation, and erosion control contribute to environmentally friendly construction practices. Companies operating in the construction fabrics market must align their strategies with the broader trend towards green and sustainable building materials.

Global economic conditions and industrial activities further contribute to the dynamics of the construction fabrics market. Economic growth leads to increased investments in infrastructure development and construction projects, driving the demand for construction fabrics. Conversely, economic downturns may lead to a temporary reduction in construction activities, impacting the dynamics of the construction fabrics market. The cyclical nature of the economy adds an element of unpredictability to market trends.

Regulatory standards and compliance also play a crucial role in shaping the construction fabrics market dynamics. Geotextiles and other construction fabrics must meet specific engineering and environmental standards to ensure their suitability for use in various applications. Compliance with regulations related to material specifications, fire resistance, and environmental impact becomes integral to the competitive positioning of companies within the market. Companies must stay attuned to evolving regulatory requirements to navigate the complex landscape and ensure market compliance.

Market dynamics are also influenced by the competitive landscape and regional variations. Companies operating in specific regions may tailor their products to meet local regulatory requirements and construction practices. The geographical distribution of construction activities and infrastructure projects impacts the competitiveness of fabric suppliers in specific regions. Global players often adapt their strategies to address regional variations and maintain a strong market presence. The level of competition, market consolidation, and strategic alliances within the construction fabrics market contribute to the overall dynamics of the industry.

Leave a Comment