North America : Market Leader in Rentals

North America is poised to maintain its leadership in the Construction Equipment Rental and Services Market, holding a significant market share of 30.0% as of 2024. The region's growth is driven by robust infrastructure investments, a booming construction sector, and increasing demand for rental services over ownership. Regulatory support for sustainable construction practices further enhances market dynamics, encouraging companies to adopt rental solutions for flexibility and cost-effectiveness.

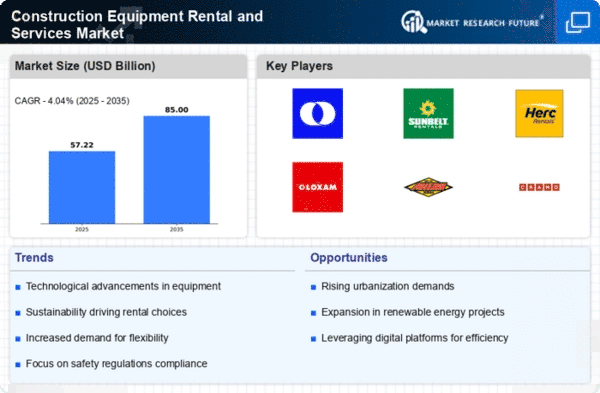

The competitive landscape is characterized by major players such as United Rentals, Sunbelt Rentals, and Herc Rentals, which dominate the market. These companies leverage advanced technologies and extensive fleets to meet diverse customer needs. The U.S. remains the largest market, while Canada and Mexico are also witnessing growth in rental services, driven by urbanization and infrastructure projects. The presence of these key players ensures a dynamic and competitive environment, fostering innovation and service diversification.

Europe : Emerging Rental Opportunities

Europe's Construction Equipment Rental and Services Market is projected to grow, with a market size of 12.0% in 2025. The region benefits from increasing urbanization, government investments in infrastructure, and a shift towards sustainable construction practices. Regulatory frameworks promoting green building initiatives are also driving demand for rental services, as companies seek to minimize capital expenditures and enhance operational efficiency.

Leading countries in this market include Germany, France, and the UK, where major players like Loxam and Cramo are expanding their operations. The competitive landscape is evolving, with a focus on technology integration and customer-centric services. The presence of established rental companies and new entrants is fostering innovation, making Europe a vibrant market for construction equipment rentals.

Asia-Pacific : Rapid Growth in Rentals

The Asia-Pacific region is witnessing a significant surge in the Construction Equipment Rental and Services Market, with a market size of 10.0% in 2025. Key growth drivers include rapid urbanization, infrastructure development, and increasing foreign investments in construction projects. Governments are also implementing policies to support the rental market, recognizing its role in enhancing project efficiency and reducing costs for contractors.

Countries like China, India, and Australia are leading the charge, with a growing number of rental companies entering the market. The competitive landscape features both local and international players, creating a dynamic environment. Companies are focusing on expanding their fleets and enhancing service offerings to meet the rising demand, positioning the region as a key player in The Construction Equipment Rental and Services.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is emerging as a potential market for Construction Equipment Rental and Services, with a market size of 3.0% in 2025. The growth is driven by increasing infrastructure projects, urbanization, and a shift towards rental services as a cost-effective solution. Governments are investing heavily in construction to support economic diversification, which is further catalyzing the demand for rental equipment.

Leading countries in this region include the UAE, South Africa, and Saudi Arabia, where key players like BMC are establishing a strong presence. The competitive landscape is characterized by a mix of local and international companies, focusing on expanding their service offerings and fleet capabilities. This dynamic environment presents opportunities for growth and innovation in the rental market.