Technological Innovations

Technological advancements play a pivotal role in shaping the Construction Abrasive Market. Innovations in abrasive materials and manufacturing processes are leading to the development of more efficient and durable products. For instance, the introduction of advanced ceramic abrasives and diamond-coated tools has significantly improved performance in various applications. These innovations not only enhance the quality of work but also reduce operational costs for construction companies. Furthermore, the integration of automation and robotics in construction processes is expected to increase the demand for specialized abrasives. As a result, the Construction Abrasive Market is likely to witness a shift towards more sophisticated and high-performance products.

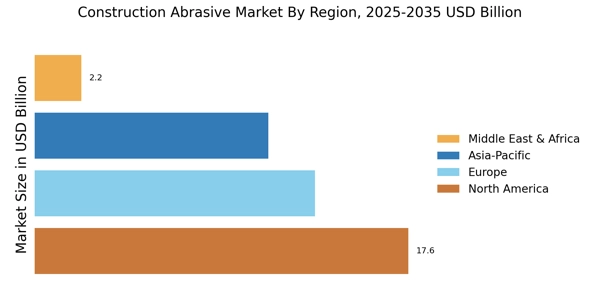

Expansion of Emerging Markets

Emerging markets are becoming increasingly important for the Construction Abrasive Market. Rapid industrialization and urban development in regions such as Asia-Pacific and Latin America are creating new opportunities for abrasive manufacturers. As these markets continue to grow, the demand for construction materials, including abrasives, is expected to rise significantly. For instance, the Asia-Pacific region is projected to account for a substantial share of The Construction Abrasive Market, leading to increased consumption of abrasives. This expansion presents a lucrative opportunity for companies to establish a foothold in these regions, thereby driving growth in the Construction Abrasive Market.

Rising Construction Activities

The Construction Abrasive Market is experiencing a surge in demand due to increasing construction activities across various sectors. Urbanization and infrastructure development projects are driving this growth, as countries invest heavily in building roads, bridges, and residential complexes. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This expansion necessitates the use of abrasives for cutting, grinding, and finishing materials, thereby boosting the market. As construction companies seek to enhance efficiency and productivity, the demand for high-quality abrasives is likely to rise, further propelling the Construction Abrasive Market.

Regulatory Compliance and Standards

The Construction Abrasive Market is influenced by stringent regulatory compliance and industry standards. Governments and regulatory bodies are implementing guidelines to ensure safety and quality in construction materials, including abrasives. Compliance with these regulations is essential for manufacturers and suppliers, as non-compliance can lead to penalties and loss of market access. As a result, companies are investing in quality assurance and certification processes to meet these standards. This focus on compliance is likely to drive demand for high-quality abrasives that adhere to safety regulations, thereby shaping the competitive landscape of the Construction Abrasive Market.

Growing Demand for Sustainable Solutions

Sustainability is becoming a crucial factor in the Construction Abrasive Market. As environmental concerns rise, construction companies are increasingly seeking eco-friendly abrasive solutions. This shift is driven by regulatory pressures and a growing awareness of the environmental impact of traditional abrasive materials. Companies are now focusing on sourcing abrasives made from recycled materials or those that minimize waste during production. The market for sustainable abrasives is projected to grow significantly, as consumers and businesses alike prioritize environmentally responsible practices. This trend not only aligns with The Construction Abrasive Industry.