Market Growth Projections

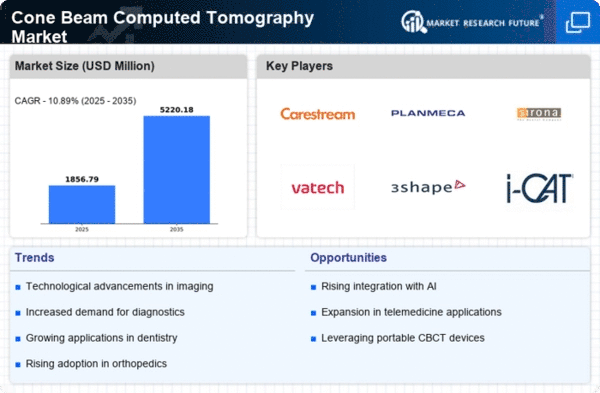

The Global Cone Beam Computed Tomography Market Industry is projected to experience substantial growth in the coming years. With a market value of 1.68 USD Billion in 2024, it is anticipated to reach 5.23 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 10.88% from 2025 to 2035. Such projections reflect the increasing adoption of cone beam computed tomography across various medical fields, driven by advancements in technology, rising healthcare demands, and supportive regulatory environments. These figures underscore the market's potential and the ongoing evolution of imaging technologies.

Technological Advancements

The Global Cone Beam Computed Tomography Market Industry is experiencing rapid technological advancements that enhance imaging capabilities. Innovations such as improved detector technology and advanced software algorithms are enabling higher resolution images and faster scanning times. These advancements not only improve diagnostic accuracy but also increase patient comfort by reducing exposure times. As a result, healthcare facilities are increasingly adopting cone beam computed tomography systems, contributing to the market's growth. The industry is projected to reach a value of 1.68 USD Billion in 2024, reflecting the impact of these technological improvements on market dynamics.

Growing Geriatric Population

The aging population worldwide is influencing the Global Cone Beam Computed Tomography Market Industry, as older adults are more susceptible to dental and oral health issues. With age, the incidence of conditions requiring advanced imaging, such as tooth loss and oral cancers, increases. Cone beam computed tomography provides essential diagnostic support in managing these conditions effectively. As the geriatric demographic expands, healthcare providers are likely to invest more in cone beam computed tomography systems to cater to this population's needs. This demographic shift is expected to drive market growth significantly in the coming years.

Rising Incidence of Oral Diseases

The increasing prevalence of oral diseases globally is a significant factor propelling the Global Cone Beam Computed Tomography Market Industry. Conditions such as periodontal disease, dental caries, and oral cancers necessitate accurate diagnostic imaging for effective treatment. Cone beam computed tomography offers detailed visualization of oral structures, aiding in early detection and intervention. As healthcare systems prioritize preventive care and early diagnosis, the demand for advanced imaging technologies is likely to rise. This trend is expected to contribute to a compound annual growth rate of 10.88% from 2025 to 2035, reflecting the market's responsiveness to healthcare needs.

Increasing Demand for Dental Imaging

The demand for dental imaging is a primary driver of the Global Cone Beam Computed Tomography Market Industry. As dental professionals seek precise imaging for treatment planning, the adoption of cone beam computed tomography is on the rise. This modality provides three-dimensional images that are crucial for implantology, orthodontics, and oral surgery. The growing awareness among patients regarding the benefits of advanced imaging techniques further fuels this demand. By 2035, the market is expected to expand significantly, reaching approximately 5.23 USD Billion, indicating a robust growth trajectory driven by the dental sector.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are crucial drivers for the Global Cone Beam Computed Tomography Market Industry. Governments and health organizations are increasingly recognizing the value of advanced imaging technologies in improving patient outcomes. As a result, there is a growing trend towards establishing reimbursement policies that cover cone beam computed tomography procedures. This financial support encourages healthcare providers to adopt these systems, thereby expanding market reach. The alignment of regulatory support with technological advancements is likely to foster a conducive environment for market growth.