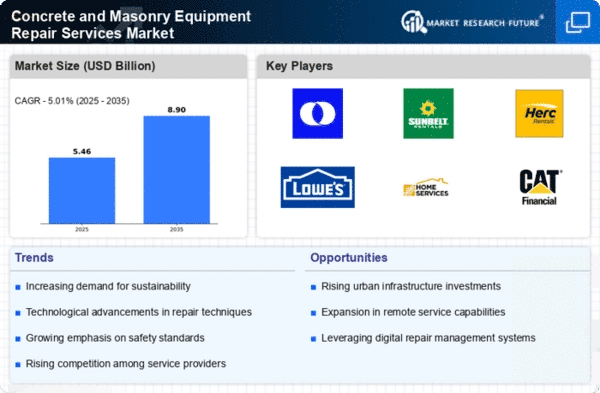

The Concrete and Masonry Equipment Repair Services Market is characterized by a competitive landscape that is increasingly shaped by innovation, strategic partnerships, and a focus on sustainability. Key players such as United Rentals (US), Sunbelt Rentals (US), and Caterpillar Inc. (US) are actively pursuing strategies that enhance their operational capabilities and market reach. United Rentals (US) has positioned itself as a leader through a robust rental fleet and a commitment to digital transformation, which allows for improved customer service and operational efficiency. Meanwhile, Sunbelt Rentals (US) emphasizes regional expansion and localized service offerings, which cater to the specific needs of diverse markets. Caterpillar Inc. (US), with its strong emphasis on technological innovation, is integrating advanced machinery with AI capabilities, thereby enhancing the efficiency of repair services and equipment management.The market structure appears moderately fragmented, with a mix of large players and smaller, specialized firms. Key business tactics such as supply chain optimization and localized manufacturing are prevalent among these companies, allowing them to respond swiftly to market demands and reduce operational costs. The collective influence of these major players shapes a competitive environment where agility and responsiveness are paramount, fostering a landscape that encourages continuous improvement and adaptation.

In November United Rentals (US) announced a strategic partnership with a leading technology firm to develop an AI-driven predictive maintenance platform. This initiative is expected to enhance the reliability of equipment and reduce downtime for clients, thereby solidifying United Rentals' position as a technology leader in the market. The strategic importance of this move lies in its potential to transform service delivery, making it more proactive rather than reactive.

In October Caterpillar Inc. (US) launched a new line of eco-friendly concrete mixers designed to reduce emissions by 30%. This initiative aligns with the growing trend towards sustainability in construction and repair services. The introduction of these mixers not only meets regulatory demands but also appeals to environmentally conscious clients, thereby expanding Caterpillar's market share in a competitive landscape increasingly focused on green solutions.

In September Sunbelt Rentals (US) expanded its operations into the Midwest, opening several new service centers. This expansion is strategically significant as it allows Sunbelt to tap into a growing market for construction and repair services in that region. By enhancing its geographical footprint, Sunbelt is likely to increase its customer base and improve service delivery times, which are critical factors in maintaining competitive advantage.

As of December the competitive trends in the Concrete and Masonry Equipment Repair Services Market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming increasingly important, as companies seek to leverage complementary strengths to enhance service offerings. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to adapt to these evolving trends.