Technological Innovations

Technological innovations play a pivotal role in shaping the Composite Preform Market. Advancements in manufacturing processes, such as automated fiber placement and 3D printing, are enhancing the efficiency and precision of composite preform production. These technologies enable the creation of complex geometries that were previously unattainable, thus expanding the application range of composite materials. The integration of smart technologies, such as IoT and AI, is also streamlining production and quality control processes. As a result, the market is expected to witness a surge in demand, with projections indicating a potential increase in market size by 20% over the next decade. Companies that invest in these technological advancements are likely to enhance their operational efficiency and product offerings.

Automotive Industry Growth

The growth of the automotive industry is a significant driver for the Composite Preform Market. As automotive manufacturers increasingly focus on reducing vehicle weight to improve fuel efficiency and meet stringent emissions regulations, the demand for composite materials is surging. The automotive sector is anticipated to grow at a rate of 5% per year, with a notable shift towards electric vehicles, which often utilize composite preforms for lightweight components. This transition not only enhances vehicle performance but also aligns with sustainability goals. Consequently, the composite preform market is likely to experience robust growth, as automotive manufacturers seek innovative solutions to meet evolving consumer preferences and regulatory requirements.

Expanding Aerospace Sector

The expanding aerospace sector significantly impacts the Composite Preform Market. With the increasing demand for lightweight and high-strength materials, composite preforms are becoming essential in aircraft manufacturing. The aerospace industry is projected to grow at a rate of 4% annually, driven by rising air travel and the need for fuel-efficient aircraft. Composite materials, including preforms, are favored for their ability to reduce weight while maintaining structural integrity. This trend is likely to propel the demand for composite preforms, as manufacturers seek to enhance performance and reduce operational costs. The integration of composite materials in aerospace applications is expected to create substantial opportunities for growth within the market.

Sustainability Initiatives

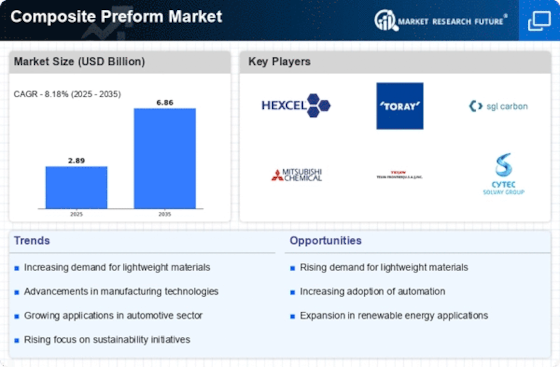

The Composite Preform Market is increasingly influenced by sustainability initiatives. As industries strive to reduce their carbon footprint, the demand for eco-friendly materials is rising. Composite preforms, often made from recyclable materials, align with these sustainability goals. This shift is evident in sectors such as automotive and aerospace, where manufacturers are adopting lightweight materials to enhance fuel efficiency. The market for composite preforms is projected to grow at a compound annual growth rate of approximately 6% over the next five years, driven by the need for sustainable solutions. Companies that prioritize sustainability in their product offerings are likely to gain a competitive edge, as consumers and regulatory bodies increasingly favor environmentally responsible practices.

Rising Demand in Wind Energy

The rising demand in the wind energy sector is emerging as a crucial driver for the Composite Preform Market. As countries invest in renewable energy sources, the need for efficient and durable materials for wind turbine blades is increasing. Composite preforms, known for their lightweight and high-strength properties, are ideal for this application. The wind energy market is projected to grow at a compound annual growth rate of 8% over the next several years, driven by the global push for sustainable energy solutions. This trend is likely to create significant opportunities for manufacturers of composite preforms, as they cater to the growing requirements of the wind energy sector.