Increased Focus on Sustainability

The heightened focus on sustainability is a significant driver for the Commercial Water Heaters Market. As businesses become more environmentally conscious, there is a growing demand for water heating solutions that minimize carbon footprints and utilize renewable energy sources. This trend is evident in the rising popularity of solar water heaters and energy-efficient models that comply with sustainability standards. Market analysis suggests that the shift towards sustainable practices is expected to influence purchasing decisions, with consumers increasingly favoring products that demonstrate environmental responsibility. Furthermore, companies that adopt sustainable practices may benefit from enhanced brand loyalty and customer trust, thereby driving market growth. The emphasis on sustainability is likely to continue shaping the industry in the coming years.

Regulatory Compliance and Standards

Regulatory compliance plays a crucial role in shaping the Commercial Water Heaters Market. Governments and regulatory bodies are increasingly implementing stringent standards aimed at improving energy efficiency and reducing environmental impact. For instance, regulations regarding emissions and energy consumption are compelling manufacturers to innovate and produce more efficient water heating solutions. The introduction of energy efficiency standards, such as those set by the Department of Energy, has led to a shift in consumer preferences towards compliant products. This trend is likely to drive the market as businesses seek to adhere to regulations while also benefiting from potential cost savings associated with energy-efficient systems. As a result, the focus on compliance not only influences product development but also enhances the overall market landscape.

Rising Demand for Hot Water Solutions

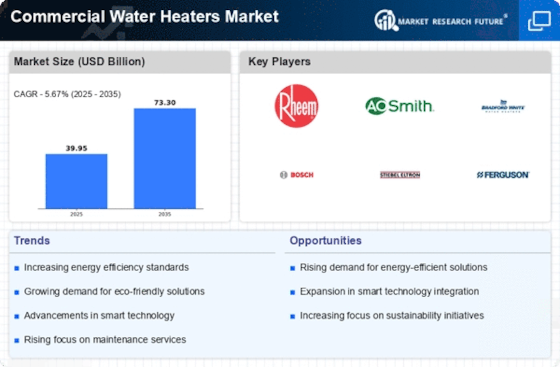

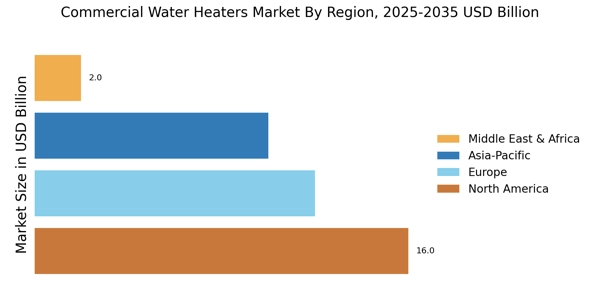

The increasing demand for hot water solutions across various sectors is a primary driver for the Commercial Water Heaters Market. Industries such as hospitality, healthcare, and food service require consistent and reliable hot water supply for their operations. According to recent data, the commercial sector is projected to account for a substantial share of the water heater market, with an expected growth rate of approximately 5% annually. This demand is further fueled by the expansion of commercial establishments, which necessitates efficient water heating systems. As businesses prioritize customer satisfaction and operational efficiency, the need for advanced commercial water heaters becomes more pronounced. Consequently, manufacturers are focusing on developing innovative products that cater to this growing demand, thereby enhancing their market presence.

Expansion of Commercial Infrastructure

The expansion of commercial infrastructure is a pivotal driver for the Commercial Water Heaters Market. As urbanization accelerates and new commercial projects emerge, the demand for efficient water heating solutions is on the rise. Sectors such as retail, education, and healthcare are experiencing significant growth, necessitating the installation of reliable water heating systems. Recent projections indicate that the commercial construction sector is expected to grow by approximately 4% annually, further fueling the need for advanced water heating technologies. This expansion not only creates opportunities for manufacturers but also encourages innovation in product offerings. As businesses seek to enhance operational efficiency and meet customer expectations, the demand for commercial water heaters is likely to remain robust.

Technological Advancements in Heating Systems

Technological advancements are significantly influencing the Commercial Water Heaters Market. Innovations such as tankless water heaters, heat pump technology, and solar water heating systems are gaining traction due to their efficiency and sustainability. The integration of smart technology, including IoT-enabled systems, allows for real-time monitoring and control, optimizing energy usage and reducing operational costs. Market data indicates that the adoption of smart water heaters is expected to rise, with a projected increase of 20% in the next five years. These advancements not only improve the performance of water heating systems but also align with the growing consumer preference for eco-friendly solutions. As technology continues to evolve, it is likely to reshape the competitive landscape of the market.