Increasing Trade Activities

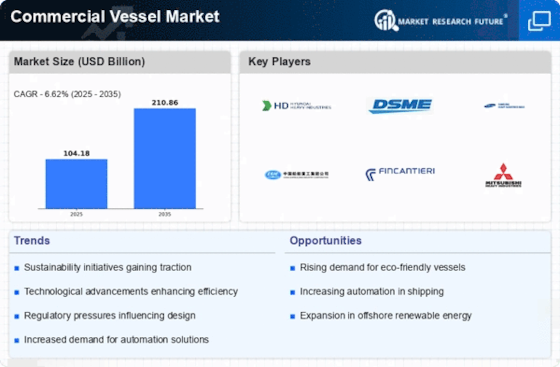

The Commercial Vessel Market is experiencing a surge in demand due to increasing trade activities across various sectors. As economies expand, the need for efficient transportation of goods has become paramount. In 2025, the total volume of seaborne trade is projected to reach approximately 12 billion tons, indicating a robust growth trajectory. This growth is likely to drive investments in commercial vessels, as shipping companies seek to enhance their fleets to meet rising demand. Furthermore, the expansion of e-commerce has necessitated faster and more reliable shipping solutions, further propelling the Commercial Vessel Market. The interplay between trade growth and vessel demand suggests a dynamic environment where shipping companies must adapt to remain competitive.

Expansion of Maritime Infrastructure

The Commercial Vessel Market is benefiting from the expansion of maritime infrastructure, which is crucial for supporting increased shipping activities. Investments in ports, terminals, and logistics facilities are enhancing the capacity and efficiency of maritime operations. In 2025, it is anticipated that global port capacity will increase by approximately 10%, facilitating smoother trade flows. This infrastructure development not only supports existing shipping routes but also opens new opportunities for trade, particularly in emerging markets. As infrastructure improves, the Commercial Vessel Market is likely to see a corresponding rise in demand for vessels capable of navigating these enhanced facilities. The synergy between infrastructure growth and vessel demand presents a promising outlook for the industry.

Regulatory Compliance and Safety Standards

The Commercial Vessel Market is increasingly influenced by stringent regulatory compliance and safety standards. Governments and international bodies are implementing more rigorous regulations to ensure maritime safety and environmental protection. For instance, the International Maritime Organization has set ambitious targets for reducing greenhouse gas emissions from shipping by at least 50% by 2050. This regulatory landscape compels vessel manufacturers and operators to invest in advanced technologies and sustainable practices. As a result, the demand for vessels that meet these evolving standards is likely to rise, creating opportunities for innovation within the Commercial Vessel Market. Companies that proactively adapt to these regulations may gain a competitive edge in a market that is becoming more compliance-driven.

Technological Advancements in Vessel Design

The Commercial Vessel Market is witnessing transformative changes due to technological advancements in vessel design and construction. Innovations such as digital twin technology, automation, and advanced materials are enhancing vessel performance and efficiency. For example, the integration of smart technologies allows for real-time monitoring of vessel operations, leading to optimized fuel consumption and reduced operational costs. In 2025, it is estimated that the adoption of such technologies could improve fuel efficiency by up to 20% across the fleet. This trend not only benefits operators through cost savings but also aligns with the industry's sustainability goals. As technological capabilities continue to evolve, the Commercial Vessel Market is likely to see a shift towards more sophisticated and efficient vessels.

Growing Demand for Sustainable Shipping Solutions

The Commercial Vessel Market is increasingly driven by the growing demand for sustainable shipping solutions. Stakeholders, including consumers and regulatory bodies, are placing greater emphasis on environmental responsibility. This shift is prompting shipping companies to explore alternative fuels, such as LNG and hydrogen, as well as energy-efficient vessel designs. In 2025, the market for eco-friendly vessels is projected to grow by over 15%, reflecting a significant shift in consumer preferences. Companies that prioritize sustainability are likely to enhance their market position, as they align with the values of environmentally conscious consumers. The emphasis on sustainability is reshaping the Commercial Vessel Market, pushing it towards greener practices and technologies.

.png)