Rise of Electric and Hybrid Vehicles

The shift towards electric and hybrid vehicles is reshaping the Commercial Vehicle Clutch Market. As more manufacturers invest in electric drivetrains, the demand for traditional clutch systems is evolving. Electric vehicles often utilize single-speed transmissions, which may reduce the need for conventional clutches. However, hybrid vehicles still require advanced clutch systems to manage the transition between electric and combustion engines. This duality presents a unique opportunity for manufacturers to innovate and develop specialized clutches that cater to both electric and hybrid applications. Market data indicates that the electric vehicle segment is expected to grow at a rate of approximately 20% annually, suggesting a potential shift in clutch design and functionality to accommodate these new technologies.

Increased Demand for Automated Systems

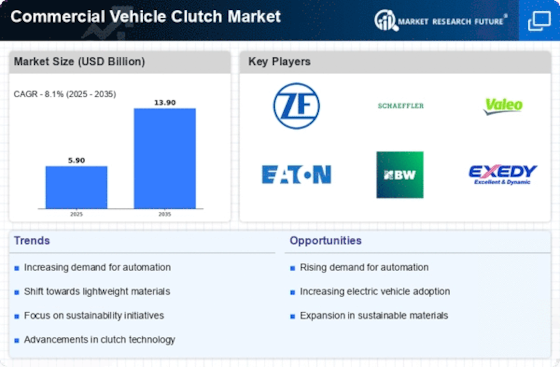

The Commercial Vehicle Clutch Market is witnessing a surge in demand for automated systems, driven by the need for enhanced operational efficiency and reduced driver fatigue. Automated manual transmissions (AMTs) are becoming increasingly popular in commercial vehicles, as they offer seamless gear shifting without the need for manual intervention. This trend is particularly evident in logistics and transportation sectors, where efficiency is paramount. Market analysis reveals that the adoption of AMTs is projected to increase by over 15% in the next five years, indicating a strong preference for automated solutions. As a result, manufacturers are focusing on developing clutches that are compatible with these systems, ensuring that they meet the performance and reliability standards required by modern commercial vehicles.

Growth of E-commerce and Logistics Sector

The Commercial Vehicle Clutch Market is benefiting from the rapid growth of the e-commerce and logistics sector. As online shopping continues to rise, the demand for commercial vehicles to transport goods is increasing correspondingly. This surge in demand necessitates the use of reliable and efficient clutch systems to ensure optimal vehicle performance. The logistics sector, in particular, is focusing on enhancing delivery efficiency, which directly impacts the need for advanced clutch technologies. Market projections indicate that the logistics industry will expand by over 8% annually, driving the need for robust commercial vehicles equipped with high-performance clutches. Consequently, manufacturers are likely to invest in research and development to create clutches that can withstand the rigors of increased usage in this burgeoning sector.

Regulatory Compliance and Emission Standards

The Commercial Vehicle Clutch Market is significantly influenced by stringent regulatory compliance and emission standards. Governments worldwide are implementing stricter regulations to reduce greenhouse gas emissions and improve fuel efficiency in commercial vehicles. This regulatory landscape compels manufacturers to innovate and develop clutches that not only enhance performance but also comply with these evolving standards. The market is likely to see an increase in demand for clutches that facilitate better fuel economy and lower emissions, as companies strive to meet compliance requirements. Data suggests that the market for eco-friendly clutch systems is expected to grow by approximately 10% annually, reflecting the industry's response to regulatory pressures and the increasing importance of sustainability in vehicle design.

Technological Advancements in Clutch Systems

The Commercial Vehicle Clutch Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as dual-clutch systems and automated manual transmissions are enhancing vehicle performance and efficiency. These advancements not only improve fuel economy but also reduce emissions, aligning with global sustainability goals. The integration of smart technologies, including electronic control units, is further optimizing clutch operation, leading to smoother gear shifts and improved driver experience. As manufacturers increasingly adopt these technologies, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This trend indicates a shift towards more sophisticated clutch systems that cater to the evolving demands of commercial vehicle operators.

Leave a Comment