Shift Towards Decarbonization

The Commercial Electric Boiler Industry. As industries strive to reduce greenhouse gas emissions, electric boilers present a viable alternative to fossil fuel-based heating systems. The transition to electric heating aligns with international climate agreements and national targets for carbon neutrality. Recent reports indicate that sectors such as manufacturing and hospitality are increasingly adopting electric boilers to meet their decarbonization goals. This trend is likely to accelerate as more businesses recognize the long-term benefits of sustainable practices. The Commercial Electric Boiler Market stands to gain from this shift, as electric boilers are positioned as a key component in the journey towards a low-carbon economy.

Growing Industrial Applications

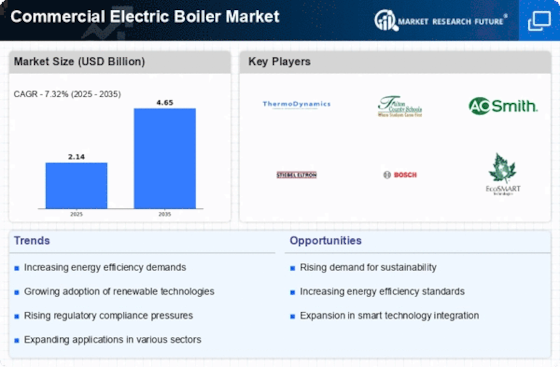

The expansion of industrial applications is driving growth in the Commercial Electric Boiler Market. Various sectors, including food processing, pharmaceuticals, and textiles, are increasingly utilizing electric boilers for their heating needs. The versatility and reliability of electric boilers make them suitable for a wide range of industrial processes. Recent data suggests that the industrial segment accounts for a substantial share of the electric boiler market, with projections indicating a compound annual growth rate of 5% over the next five years. As industries continue to modernize and seek efficient heating solutions, the demand for electric boilers is expected to rise, further solidifying the position of the Commercial Electric Boiler Market.

Government Incentives and Support

Government policies and incentives play a crucial role in shaping the Commercial Electric Boiler Market. Many governments are implementing programs that encourage the adoption of electric heating solutions. These initiatives often include tax credits, rebates, and grants aimed at businesses that invest in energy-efficient technologies. For instance, certain regions have reported a 20% increase in electric boiler installations due to favorable government policies. Such support not only alleviates the financial burden on businesses but also aligns with broader environmental goals. As governments continue to prioritize sustainability, the Commercial Electric Boiler Market is likely to benefit from increased investments and installations, further driving market growth.

Rising Demand for Energy Efficiency

The increasing emphasis on energy efficiency is a primary driver for the Commercial Electric Boiler Market. Businesses are actively seeking solutions that reduce energy consumption and operational costs. Electric boilers, known for their efficiency, are becoming a preferred choice. According to recent data, electric boilers can achieve efficiency ratings of up to 99%, which is significantly higher than traditional gas boilers. This trend is likely to continue as companies aim to meet sustainability goals and reduce their carbon footprint. The shift towards energy-efficient technologies is not merely a trend but a necessity, as energy costs continue to rise. Consequently, the demand for electric boilers is expected to grow, positioning the Commercial Electric Boiler Market favorably in the coming years.

Technological Innovations in Electric Boilers

Technological advancements are significantly influencing the Commercial Electric Boiler Market. Innovations such as smart controls, improved heating elements, and enhanced safety features are making electric boilers more appealing to businesses. The integration of IoT technology allows for real-time monitoring and optimization of boiler performance, which can lead to substantial energy savings. Recent studies indicate that the adoption of smart electric boilers can reduce energy costs by up to 30%. As these technologies become more prevalent, they are expected to attract a wider range of customers, thereby expanding the market. The ongoing evolution of electric boiler technology suggests a promising future for the Commercial Electric Boiler Market.