Top Industry Leaders in the Commercial Aircraft Health Monitoring Systems Market

Key Players and Market Dominance:

Airbus (France),

Boeing (U.S.),

Bombardier (Canada),

Embraer (Brazil),

Gulfstream (U.S.),

Acellent Technologies, Inc. (U.S.),

BeanAir (Germany),

Curtiss-Wright Corporation (U.S.),

FLYHT Aerospace Solutions Ltd. (Canada),

General Electric Company (U.S.),

Honeywell International Inc. (U.S.),

Meggitt PLC (U.K.),

Rolls-Royce plc (U.K.),

RSL Electronics Ltd. (Israel),

Safran S.A. (France),

United Technologies Corporation (U.S.)

Strategies Adopted: To maintain a competitive edge, key players employ various strategies, ranging from technological innovation to strategic partnerships. Continuous investments in research and development are paramount, enabling companies to introduce state-of-the-art avionics systems that comply with the latest safety standards and regulations. Collaborations with aircraft manufacturers and airlines also play a crucial role, ensuring seamless integration of avionics solutions into new aircraft designs. Additionally, strategic mergers and acquisitions are common, allowing companies to broaden their product portfolios and expand their global reach.

Factors for Market Share Analysis: Market share analysis in the commercial aircraft avionics systems sector is influenced by several factors. Technological capabilities and the ability to provide comprehensive, integrated solutions are key determinants. Companies that can offer avionics suites covering navigation, communication, surveillance, and automation systems gain a competitive advantage. Compliance with stringent safety and regulatory standards is another critical factor, as aviation authorities worldwide prioritize systems that enhance overall safety and situational awareness. Pricing strategies, customer relationships, and aftermarket support services also contribute significantly to market share dynamics.

New and Emerging Companies: The commercial aircraft avionics systems market has witnessed the emergence of new players striving to disrupt the status quo. Startups and smaller enterprises are leveraging advancements in digital technology, artificial intelligence, and data analytics to bring innovative avionics solutions to the market. These companies often focus on niche areas, providing specialized systems or services that address specific challenges faced by the aviation industry. The agility and fresh perspectives of these newcomers pose a potential threat to established players, prompting the industry to stay vigilant and adapt to the evolving landscape.

Industry News and Trends: Industry news and trends in the commercial aircraft avionics systems market are indicative of the sector's trajectory. Continuous advancements in satellite navigation technology, the integration of more sensors for enhanced situational awareness, and the development of communication systems capable of handling increasing data loads are some of the notable trends. Moreover, the adoption of open architecture systems and modular avionics designs is gaining traction, allowing for easier upgrades and compatibility with future technologies. Cybersecurity concerns have also become prominent, pushing companies to invest in robust solutions to protect avionics systems from potential threats.

Current Company Investment Trends: Companies in the commercial aircraft avionics systems market are witnessing a shift in investment trends driven by the need for digital transformation. Investments in software development, data analytics, and connectivity solutions are on the rise as the industry embraces the era of connected aircraft. Companies are also investing in developing avionics systems that align with the sustainability goals of the aviation sector, focusing on fuel efficiency and reduced environmental impact. Additionally, investments in talent acquisition and training programs reflect the industry's commitment to staying at the forefront of technological innovation.

Overall Competitive Scenario: The overall competitive scenario in the commercial aircraft avionics systems market is characterized by a delicate balance between established players, new entrants, and evolving technologies. Established companies maintain their dominance through a combination of experience, reputation, and ongoing innovation. The threat of disruption from new entrants is countered by the industry's adaptability and a continuous drive for improvement. The market's resilience is evident in its ability to absorb technological shifts, regulatory changes, and global economic fluctuations.

Recent News & Development :

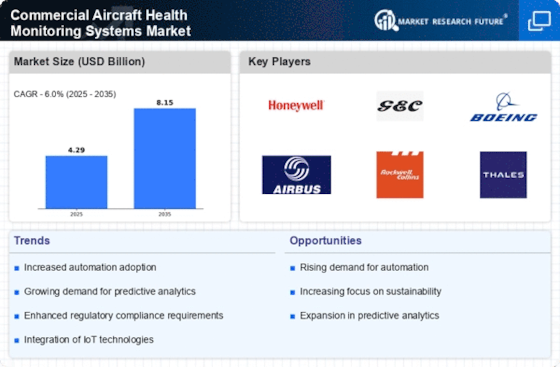

The market for commercial aircraft avionics systems is dominated by key players that have established a strong foothold in the industry. Companies such as Honeywell International Inc., Rockwell Collins, Thales Group, and Garmin Ltd. have long been synonymous with cutting-edge avionics technologies. These industry giants invest heavily in research and development to maintain their technological edge, often resulting in a significant market share. Their established presence enables them to cater to a wide range of aircraft types, from regional jets to long-haul giants.