Growth of E-commerce and Logistics Sector

The growth of the e-commerce and logistics sector is a significant driver for the Commercial Air Brake Market. As online shopping continues to gain traction, the demand for efficient logistics and transportation solutions has surged. This trend has led to an increase in the number of delivery vehicles, which in turn drives the need for reliable braking systems. The logistics sector is expected to expand at a robust pace, with projections indicating a growth rate of around 6% annually. This expansion necessitates the adoption of advanced air brake systems to ensure the safety and efficiency of commercial vehicles. Consequently, the Commercial Air Brake Market stands to benefit from the increasing reliance on logistics and e-commerce, as more vehicles require sophisticated braking solutions.

Increasing Demand for Commercial Vehicles

The rising demand for commercial vehicles is a primary driver of the Commercial Air Brake Market. As economies expand, the need for transportation of goods and services increases, leading to a higher production of commercial vehicles. According to recent data, the commercial vehicle segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth directly correlates with the demand for efficient and reliable braking systems, as safety regulations become more stringent. Consequently, manufacturers are compelled to innovate and enhance their air brake systems to meet these evolving standards. The Commercial Air Brake Market is thus positioned to benefit from this upward trend in vehicle production, as more vehicles on the road necessitate advanced braking solutions.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards play a crucial role in shaping the Commercial Air Brake Market. Governments worldwide are implementing stringent regulations to ensure the safety of commercial vehicles, which includes the performance of braking systems. For instance, regulations regarding stopping distances and brake performance are becoming increasingly rigorous. This trend compels manufacturers to invest in research and development to create air brake systems that not only meet but exceed these safety requirements. The emphasis on safety is likely to drive innovation within the industry, as companies strive to develop advanced braking technologies. As a result, the Commercial Air Brake Market is expected to witness growth driven by the need for compliance with these evolving safety standards.

Focus on Fuel Efficiency and Cost Reduction

The focus on fuel efficiency and cost reduction is increasingly shaping the Commercial Air Brake Market. As fuel prices fluctuate, commercial vehicle operators are seeking ways to minimize operational costs, which includes optimizing braking systems. Efficient air brake systems can contribute to better fuel economy by reducing vehicle weight and enhancing overall performance. Manufacturers are responding to this demand by developing lighter and more efficient braking solutions that do not compromise safety. This trend is likely to drive innovation within the industry, as companies strive to create products that align with the cost-saving objectives of their customers. The emphasis on fuel efficiency is expected to propel the Commercial Air Brake Market forward, as operators prioritize cost-effective solutions.

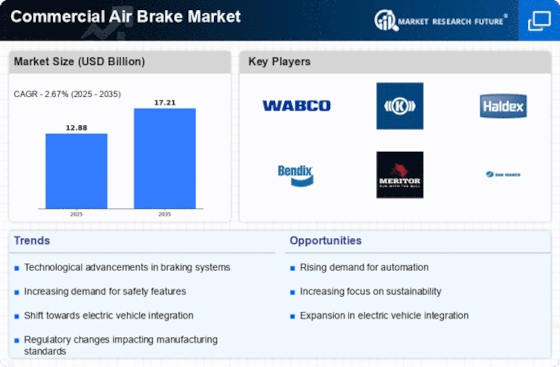

Technological Innovations in Braking Systems

Technological innovations are significantly influencing the Commercial Air Brake Market. The advent of advanced materials and smart technologies is transforming traditional braking systems into more efficient and reliable solutions. Innovations such as anti-lock braking systems (ABS) and electronic braking systems (EBS) are becoming increasingly prevalent in commercial vehicles. These technologies enhance vehicle safety and performance, which is crucial in a competitive market. Furthermore, the integration of telematics and data analytics into braking systems allows for real-time monitoring and predictive maintenance, thereby reducing downtime and operational costs. As these technologies continue to evolve, they are likely to drive the demand for advanced air brake systems, positioning the Commercial Air Brake Market for substantial growth.