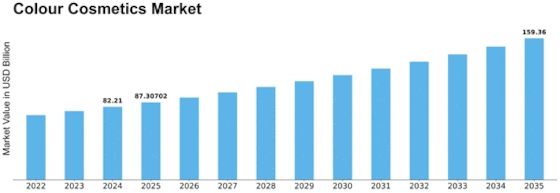

Colour Cosmetics Size

Colour Cosmetics Market Growth Projections and Opportunities

The Color Cosmetics Market is extremely susceptible to changing consumer tastes. Changing ideas about what makes someone beautiful, makeup styles, and living choices all have a big effect on the market for different color cosmetics. People want new, customized beauty items that look good on a lot of different people. Market growth is supported by constant changes in the ingredients used in cosmetics. More and more, people are choosing products with better formulas that offer benefits like long-lasting wear, hydration, and skin care. Tolerance and acceptance of different racial and cultural backgrounds are very important issues in the Color Cosmetics Market. Brands are adding more products to their lines to cover more skin tones. This is to make sure that everyone can use them and to meet the need for makeup that work for people of all races and cultures. A major development that changes the Color Cosmetics market is the rise of "clean beauty" styles. Customers want more and more products that are made from natural, clean materials and don't have any chemicals that are bad for you. It's better for the world for people to do business with companies that value being open and having long-term success. The makeup business is changing because of e-commerce sites and online sales. Because people like the ease of buying online, makeup companies use successful online marketing strategies like virtual try-ons and making their products more available to customers all over the world. There are big changes in the Color Cosmetics Market because of influencer marketing and relationships with famous people. Influencers and celebrities showing off their beauty looks on social media sites have a big impact on what people buy, which makes more people want to buy goods that celebrities promote. The rise of small makeup businesses is changing the way the market works. Indie businesses usually focus on narrow markets, making color products that are unique and creative and appeal to a certain group of people. Independent businesses are getting a bigger part of the market because they can adapt quickly to new trends. People who work in the beauty business want to use environmentally friendly packing methods because they are in high demand. Companies that use eco-friendly handling materials and do less damage to the environment have an advantage over their rivals because more people care about the environment when they shop. In the Color Cosmetics Market, personalization and customization are becoming more and more common. To suit the likes and skin tones of their customers, brands offer customizable color schemes, one-of-a-kind makeup solutions, and color options that can be mixed and matched. The way men think about being beautiful and groomed is changing, and so are the cosmetics they use. Men's beauty trends affect the industry, as there is more demand for color cosmetics geared toward men, like concealers, hair products, and makeup with health ingredients. The influences on color makeup from the market show the link between looks and health. People want to buy things that not only make them look better but also help their skin stay healthy. The health and fitness trend fits with the use of skin-care ingredients in color makeup.

Leave a Comment