Top Industry Leaders in the Collaborative Robots Market

Competitive Landscape of the Collaborative Robots Market:

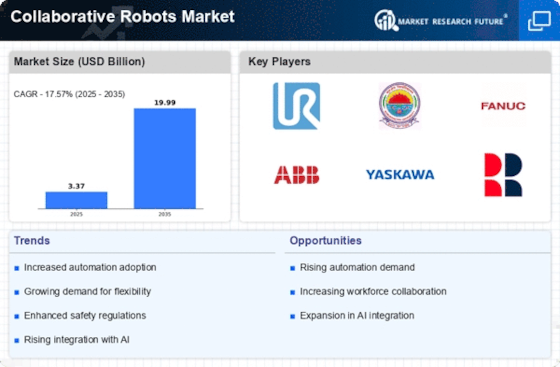

The collaborative robots (cobots) market is experiencing a surge, spurred by rising automation desires, labor shortages, and increasing safety concerns. This dynamic landscape is attracting established players and new entrants alike, leading to a fiercely competitive environment.

Key Players:

- Denso Corporation

- Universal Robots

- Precise Automation

- ABB

- Doosan Robotics

- FANUC

- KUKA

- Robot Bosch

- Ingrid technologies

Strategies Adopted by Key Players:

The competitive landscape is witnessing a shift towards:

- Software and services: Cobots are evolving into platforms with advanced software for programming, analytics, and remote monitoring. Subscription-based service models are gaining traction.

- Ecosystem building: Partnerships with software developers, end-effector manufacturers, and training providers are creating comprehensive cobot ecosystems.

- Vertical specialization: Companies are focusing on specific industries, developing deep expertise and customized solutions.

- Safety advancements: Collaborative features like force limiting and vision sensing are being constantly refined to ensure seamless human-robot interaction.

Market Share Analysis:

Delving into market share analysis requires a comprehensive approach. Traditional metrics like revenue and unit shipments remain crucial, but factors like:

- Technology leadership: Innovation in areas like AI integration, intuitive programming, and advanced sensors differentiates leaders.

- Application expertise: Deep understanding of specific industry needs and offering tailored cobot solutions.

- Customer service and support: Prompt and effective support throughout the cobot lifecycle.

- Geographical reach: Presence in key markets and adaptation to regional regulations.

- Partnerships and collaborations: Strategic alliances with technology providers, system integrators, and distributors.

Established Players:

Universal Robots (UR), Fanuc, and ABB command significant market shares, leveraging their established global presence, diverse product portfolios, and extensive experience in automation solutions. They invest heavily in R&D, cater to various industries, and offer robust training and support programs.

New Entrants:

Start-ups like TechMan Robot, Doosan Robotics, and AUBO Robotics are shaking things up with:

- Cost-effective and user-friendly cobots: Targeting smaller businesses and less complex tasks.

- Industry-specific solutions: Developing cobots tailored to specific applications like welding, assembly, and material handling.

- Cloud-based programming and monitoring: Simplifying deployment and management.

- Open-source platforms: Enabling customization and integration with existing workflows.

Industry Developments

Denso Corporation:

- August 2023: Denso Robotics and Yaskawa America Inc. (Motoman Robotics) announce a strategic partnership to expand cobot product offerings and market reach.

- July 2023: Denso unveils the VS057L cobot, designed for high-precision assembly tasks in a small footprint.

- April 2023: Denso partners with Preferred Robotics, a supplier of automated feeding and assembly solutions, to provide integrated cobot systems.

Universal Robots:

- May 2023: Universal Robots secures a major partnership with Denali Advanced Integration, becoming their largest Certified Solution Partner (CSP). This is expected to boost cobot adoption through Denali's Automation-As-A-Service (AaaS) offerings.

- March 2023: Universal Robots launches the UR10e cobot, offering increased payload capacity and reach for heavier tasks.

- February 2023: Universal Robots announces a collaboration with Microsoft to integrate cloud-based cobot programming and monitoring, aiming to simplify setup and management.