Research Methodology on Cocoa Fillings Market

1. Introduction

The research methodology used for this report is an integrative approach that fully analyses the cocoa fillings market and produces market forecasts for 2023 to 2030. This includes both primary and secondary research techniques. Primary research involves direct interviews and surveys with industry experts, market players, and entrepreneurs. On the other hand, secondary data was obtained from various sources including company databases, relevant publications, government databases, and other publicly available sources. The data obtained from the primary research was then further analyzed and interpreted through statistical techniques such as linear regression, ANOVA, correlation and factor analysis.

2. Goal and Objectives

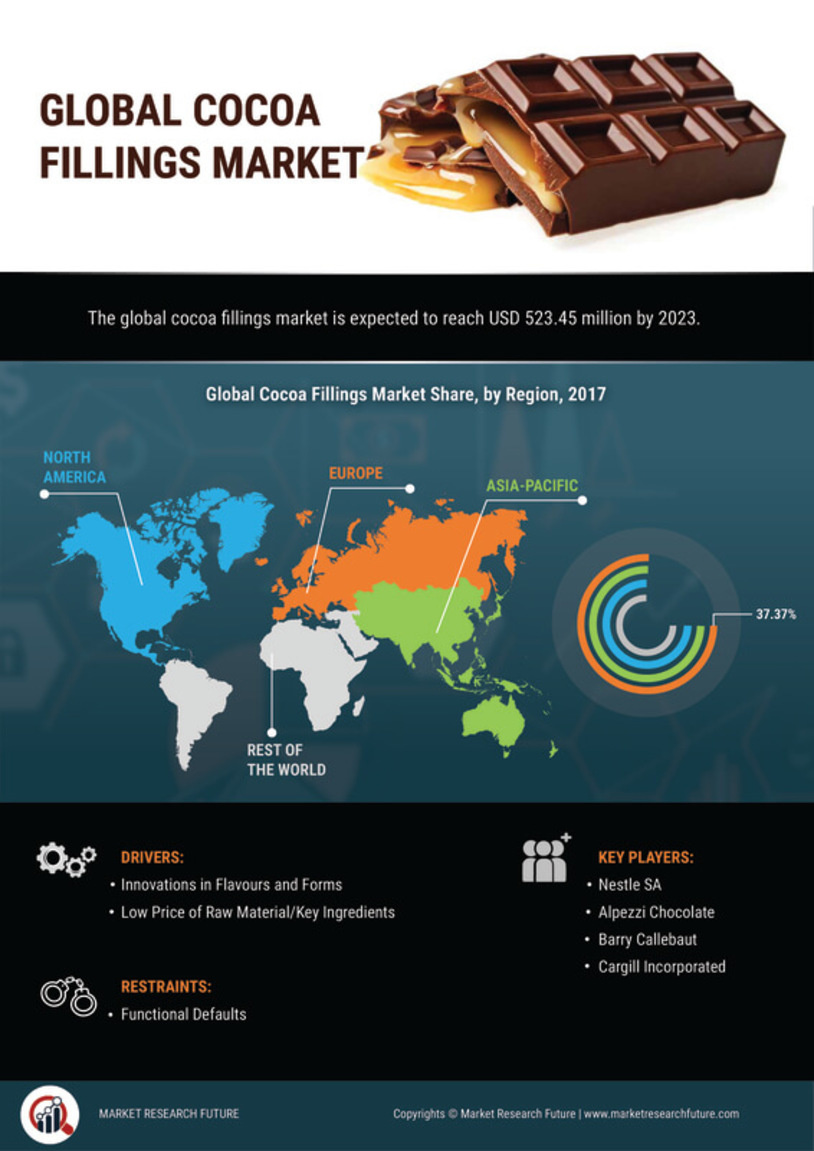

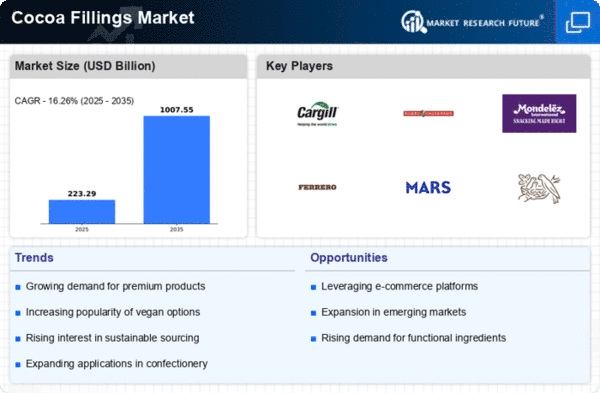

The main goal of the report is to analyse the growth of the cocoa fillings market. The objectives of the report are to identify the developments, trends, and drivers of growth, and to analyse the competitive landscape. Specific objectives include analyzing the factors that are driving the demand for cocoa fillings; identifying the major applications, producers, and suppliers of cocoa fillings; assessing the market size; analyzing the competitive landscape; determining the financial outlook of the market; and assessing the impact of the trends on the market. To achieve these objectives, all the available data was scrutinised and discussed with participants involved in the cocoa market.

3. Research Design

The research design adopted for this report is a combination of both quantitative and qualitative techniques. The data was gathered from both primary and secondary sources. Primary research will involve conducting surveys and interviews with participants from the cocoa fillings industry. The primary research data obtained will be further analyzed using various statistical methods and software. The secondary data was gathered from published reports, industry publications, government datasets, databases, press releases and other publicly available sources.

4. Sampling

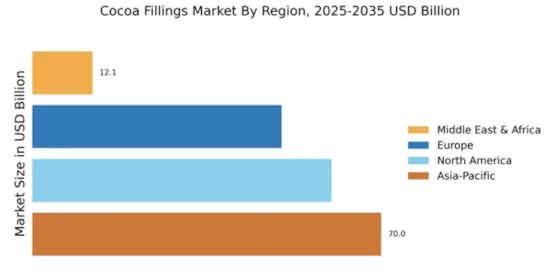

The sampling procedure adopted for this report was purposive sampling. The method allows the researcher to select the most suitable individuals that contain information relevant to the market. The sampling population frame was constructed based on industry expertise, regional focus, product segment, and price range. For the primary research, participants were selected from the major cocoa-filling markets, including North America, Europe, Asia-Pacific, South America, and the Rest of the World.

5. Data Collection

The data collection process for the report includes both primary and secondary sources. Primary data sources included interviews and surveys conducted with industry experts, market players, and entrepreneurs. All the interviewees provided valuable data on the cocoa fillings market from their respective points of view. The secondary data was obtained from published reports, industry publications, databases, government datasets, press releases and other publicly available sources.

6. Data Analysis

The data gathered from the primary and secondary sources was then further analyzed and interpreted through statistical techniques such as linear regression, ANOVA, correlation and factor analysis. The analysis was used to assess the market size and provide insights into the financial outlook of the market. Furthermore, the analysis was used to determine the factors driving the growth of the cocoa fillings market and identify the major trends, developments, and drivers of growth.