Diverse Application Areas

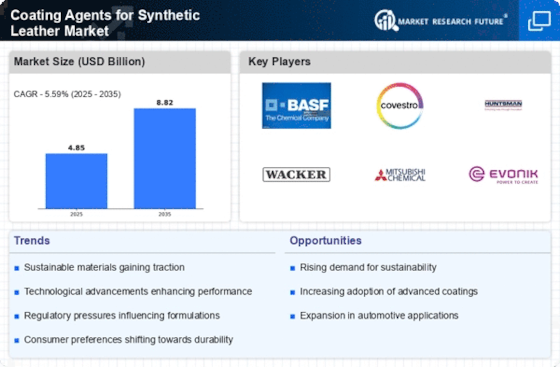

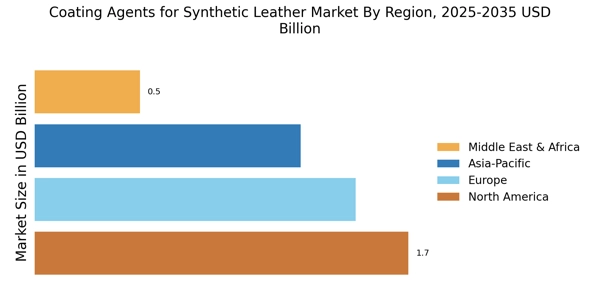

The versatility of synthetic leather has led to its adoption across various sectors, thereby propelling the Coating Agents for Synthetic Leather Market. From automotive interiors to fashion accessories, the demand for synthetic leather is expanding. The automotive sector, in particular, is projected to account for a significant share of the market, driven by the need for lightweight and durable materials. Reports indicate that the automotive segment alone is expected to grow by 5% annually, highlighting the increasing reliance on synthetic leather and its associated coating agents in diverse applications.

Technological Innovations

Technological advancements play a pivotal role in shaping the Coating Agents for Synthetic Leather Market. Innovations in polymer chemistry and application techniques have led to the development of high-performance coatings that enhance durability and aesthetic appeal. For instance, the introduction of nanotechnology in coatings has resulted in products that offer superior resistance to wear and tear. Market data suggests that the segment of high-performance coatings is expected to grow at a CAGR of 7% over the next five years, indicating a robust demand for technologically advanced solutions in synthetic leather applications.

Sustainability Initiatives

The increasing emphasis on sustainability within the Coating Agents for Synthetic Leather Market is driving demand for eco-friendly products. Manufacturers are increasingly adopting bio-based and waterborne coatings, which are less harmful to the environment compared to traditional solvent-based options. This shift aligns with consumer preferences for sustainable materials, as evidenced by a report indicating that over 60% of consumers are willing to pay more for sustainable products. As regulations tighten around environmental standards, companies that prioritize sustainability in their coating agents are likely to gain a competitive edge, thereby influencing market dynamics.

Consumer Preferences for Aesthetics

Consumer preferences are increasingly leaning towards aesthetically pleasing products, which is influencing the Coating Agents for Synthetic Leather Market. The demand for coatings that enhance the visual appeal of synthetic leather is on the rise, as consumers seek materials that mimic the look and feel of genuine leather. This trend is particularly evident in the fashion and upholstery sectors, where the aesthetic quality of synthetic leather is paramount. Market analysis indicates that the demand for decorative coatings is expected to grow by 6% over the next few years, reflecting the importance of aesthetics in consumer purchasing decisions.

Regulatory Compliance and Standards

Regulatory compliance is becoming increasingly critical in the Coating Agents for Synthetic Leather Market. Governments are implementing stricter regulations regarding the use of harmful chemicals in coatings, prompting manufacturers to innovate and adapt their formulations. This shift not only ensures consumer safety but also enhances the marketability of products that meet these standards. As a result, companies that invest in compliant and safe coating agents are likely to see increased demand. Market forecasts suggest that the segment focusing on compliant coatings will experience a growth rate of approximately 4% annually, underscoring the importance of regulatory adherence in shaping market trends.