Market Trends

Key Emerging Trends in the Co Fired Ceramic Market

The Co-Fired Ceramic market is currently challenged by the emergence of a variety of dynamic trends, which are a result of the fast technological progression and evolving consumer behavior. Miniaturization is another key trend in this industry which enhances the integration of electronics components. The smaller and more compact electronic devices progressively become, there arises a growing need for co-firing ceramic technology that enables the incorporation of several functions within one and the same ceramic substrate. This tendency can be seen in the semiconductor and electronics industry where space economy is crucially important for the innovation of high-perform and miniature devices based on the advanced technologies.

The Co-Fired Ceramic market also sees a great surge in demand owing to the growing use of sophisticated packaging methods. The ceramic co-fired technology boasts sufficiently high thermal conductivity and electrical insulating properties that make it an excellent option for electronics and semiconductor packaging. With the industries looking forward to higher performance and dependability of electronic components co-fired ceramics emerge as an essential element to deliver proper heat dispersion as well as a protection against electrical interference.

Along with its usage in electronics, the Co-Fired Ceramic market is growing in the healthcare area. The need to employ trustworthy and biocompatible materials in developing medical devices is driving the use of co-fired ceramics. These ceramics have widespread uses, including diagnostics, implantable devices and other tools because of their outstanding mechanical strength, bio-compatibility and chemical stability. This inclination marks the broader shift towards the advanced curative materials in the healthcare industry to maintain the superiority and lifelong medical devices.

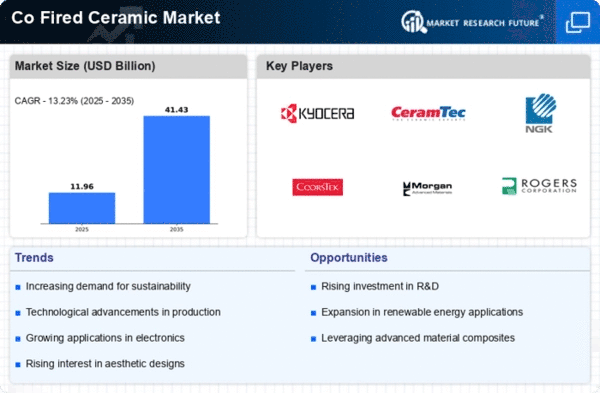

The sector of the Co-Fired Ceramic industry is being directly and indirectly affected by the global push to sustainability. As the movement towards eco practices continues to grow, manufacturers are inventing ceramic materials that are beneficial to the environment and can be reused. Ceramics is also used in the manufacturing of co-fired diodes. These are known for their resistance to wear and tear and form the basis of development of durable and long-lasting products, which, aligns with the growing consciousness towards reducing electronic waste. This trend will continue to grow in its significance with the mounting awareness and increasing importance of sustainability in the industry.

Additionally, the Co-Fired Ceramic industry is embarking on geographical expansion, expanding to developing countries. While these economies go through rapid industrialisation and technology upgrading, the consumption of co-fired ceramic components such as electronic parts, sensors and others is intensively rising.

Leave a Comment