Co Fired Ceramic Size

Co Fired Ceramic Market Growth Projections and Opportunities

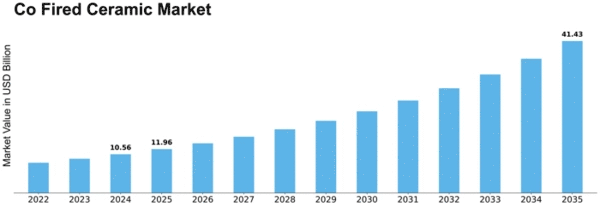

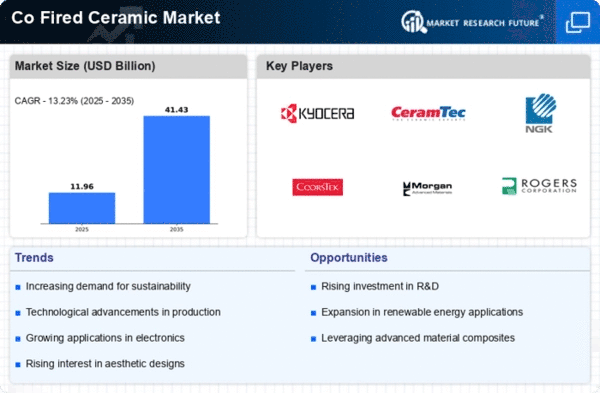

The Co-Fired Ceramic Market is subject to various determinants of market which are playing very important role in the formation its behavior. The the main cause is the fast increasing request for the electronical element in different industries. With electronic devices keeping getting more and more super miniaturized and power efficient, the need for highly advanced ceramics such as co-fired ceramics grows incessantly. They stand for best electrical and thermal characteristics that are top demanded for production of microchips of electronic components used in integrated circuit. The world ceramic market, which is co-fired, is projected to post a CAGR of 4.45% and reach 1.2 billion USD by 2025.

Also, there is the market that is affected directly by the technological advancement. This directs the subsequent research and development and makes possible such advancements in the ceramic co-fired materials that can boost their performance and expand their prospective applications. Alongside the trend of progress technology, an increasing number of industries are likely to adopt co-fired ceramics and manufacturers tend to fight each other to present the latest devices. Therefore, the market is always flooded with the consumer-friendly substitutes due to the emergence of the latest co-fired ceramic products.

Largely, this phenomenon is affected by the global environmental problems and regulations as well. Lead-free co-fired ceramics have a low toxicity and are environmentally friendly, which reduces emissions and microplastic contamination. As consumers increasingly emphasize environmental impact, industries are switching production methods to sustainable practices, and co-fired ceramics fall into this mainstream. This mindset shif is driving for the market, and companies focus on the use of environmentally friendly materials in their production processes,

In addition, Co-Fired Ceramic Market shows how it will depend on global economy and consumer expenditures patterns. Internal stability and prosperity of the economy play a crucial role in industries of electronics, telecommunications, and automotive industries as they are the biggest consumers of co-fire ceramics However, economy periods often cause a cutback of capital investment and then the demand for co-fired ceramic products decline. Consequently, market participants pay a lot of attention to various economic indicators, because they need to predict, and respond to any demand fluctuations, as swiftly as possible.

In addition, the granularity of supply chain dynamics has imminent significance on the co-fired ceramic market. Very often, the cost and availability of the raw materials, ceramics and metals, will increase the expenses of the production, which, in turn, will lead to a more expensive co-fired ceramic product. The distribution of supply chains could be disturbed even by geopolitical or human disasters and the consequences of it could be felt by the market as price movement or shortage.

Leave a Comment