Top Industry Leaders in the CMOS sCMOS Image Sensor Market

The Competitive Landscape of the CMOS and sCMOS Image Sensor Market

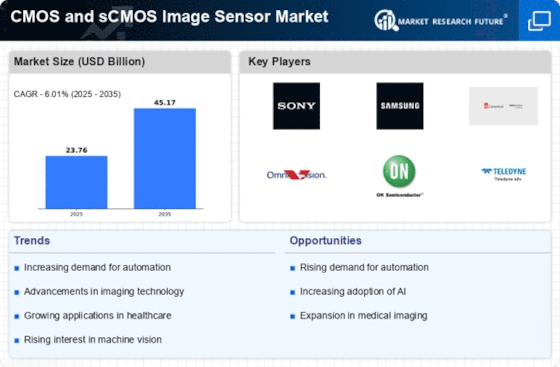

The CMOS and sCMOS image sensor market is a vibrant canvas, where pixels of innovation and competition are intricately woven. This market pulsates with opportunities for established titans and nimble startups alike. Understanding the competitive landscape is crucial for capturing a clear picture of this dynamic sphere.

Some of the CMOS and sCMOS Image Sensor companies listed below:

- BAE Systems PLC

- Sony Corporation

- Canon Inc.

- Panasonic Corporation

- Galaxycore Inc.

- SK Hynix Inc.

- ON Semiconductor Corporation

- OmniVision Technologies Inc.

- Samsung Electronics Corporation Ltd

- Teledyne Technologies Inc.

- Sharp Corporation

Strategies Adopted by Leaders

- Technological Prowess: Industry leaders like Sony, Samsung, and OmniVision invest heavily in R&D, pushing the boundaries of resolution, low-light performance, and dynamic range. Smaller players often counter with specialized sensors for niche applications or cost-effective solutions.

- Vertical Integration: Some large players, like Canon and Nikon, vertically integrate image sensor production with their camera manufacturing, ensuring tight control over quality and supply chain. Others collaborate with foundries like TSMC for greater flexibility and access to cutting-edge technology.

- Application Focus: Market leaders cater to diverse industry segments. Sony excels in consumer electronics and smartphones, while OmniVision focuses on automotive and security applications. This specialization allows for tailored solutions and deeper market penetration.

- Global Expansion: Established players aggressively expand their geographical footprint through strategic partnerships and local manufacturing facilities. Emerging companies often leverage online distribution channels to reach global markets more efficiently.

Critical Factors for Market Share Analysis

- Product Segmentation: Analysing market share by sensor type (CMOS vs. sCMOS) is crucial, as each caters to distinct needs. CMOS dominates due to its affordability and integration with consumer electronics, while sCMOS holds sway in scientific and high-precision imaging applications.

- Regional Variations: Regional demand patterns significantly impact market share. Asia Pacific leads the market due to the burgeoning middle class and strong smartphone penetration, while North America and Europe remain lucrative for high-end applications.

- Customer Segments: Understanding the needs of different customer segments (OEMs, end users, etc.) is key. For instance, smartphone manufacturers prioritize cost and integration, while scientific labs seek high performance and customizability.

New and Emerging Companies:

- SK Hynix: This Korean tech giant is rapidly entering the CMOS image sensor market, leveraging its existing semiconductor expertise and aiming to disrupt the established players.

- Aptina: Acquired by OnSemi in 2020, Aptina specializes in high-performance CMOS sensors for industrial and medical applications, carving a niche in a demanding segment.

- AMS Sensors: This Swiss company focuses on advanced micro-electro-mechanical systems (MEMS) technology, developing image sensors with integrated features like autofocus and proximity sensing, offering unique value propositions.

Industry Developments:

October 2023- Huawei will soon venture to develop its CMOS image sensor. This move is triggered via sanctions which resulted in a rift between the company & Sony, its lens supplier. The development procedure spans from the wafer to chip, including several innovative alterations, especially in thinning the stop layers related to epitaxial layers. Such innovations allow compatibility with the prevalent BSI or back-illuminated technology. The company’s venture into the self-developed CMOS technology together with innovations such as the Kirin 9000s, represent a noteworthy step ahead for the brand, bringing promising advances to their product line. The lately launched Huawei Mate60 series can potentially be amid the last to utilize sensors made by Sony.

May 2023- Ximea’s MJ042MR-GP-P11-BSI-UV model has been included to its scientific cameras portfolio. It comes with a Gpixel PulSar sCMOS sensor which is merged with the Peltier cooling & USB3 interface. Its camera body has been extended by the standard DN 63 CF vacuum flange with the additional flange formats accessible on demand. Pulsar sensor expands the spectral range from UV, VIS, and IR to the soft x-ray regime. This camera is ideal for an array of prospective applications which also includes life science applications, industrial, nanotechnology, and astronomy.

The company makes industrial or scientific-grade cameras with sCMOS, CMOS, or CCD that use USB 2.0, USB 3.1, and PCI Express (PCle) interface in different camera setups, embedded vision systems, hyper-spectral imaging or x-ray. The cameras are provided as robust housing or OEM board level, which also includes TE-cooled options.