-

EXECUTIVE SUMMARY

-

Market Attractiveness Analysis

- Global Cloud-native Application Protection Platform (CNAPP) Market, by Component

- Global Cloud-native Application Protection Platform (CNAPP) Market, by Organization Size

- Global Cloud-native Application Protection Platform (CNAPP) Market, by Industry Vertical

- Global Cloud-native Application Protection Platform (CNAPP) Market, by Region

-

MARKET INTRODUCTION

-

Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Macro Factor Indicator Analysis

-

RESEARCH METHODOLOGY

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List of Assumptions

-

MARKET DYNAMICS

-

Introduction

-

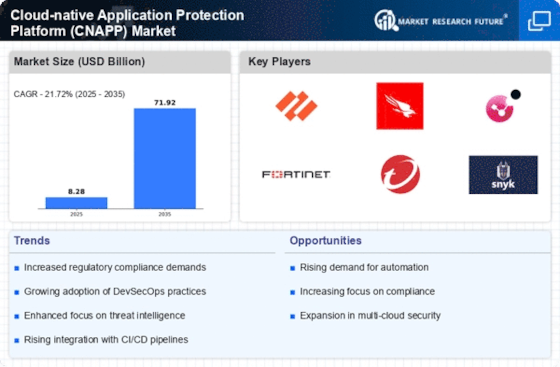

Drivers

- An increasing number of organizations are investing in CNAPPs

- Growing need for risk detection and compliance automation

- Driver impact analysis

-

Restraints

- High initial costs of CNAPP solutions

- Restraint impact analysis

-

Opportunities

- The increasing use of artificial intelligence and machine learning

- Rising need for cloud-native security

-

Covid-19 Impact Analysis

- Impact on security management

- Increased Reliance on Cloud Services

- Impact on Zero Trust Architecture

- YOY growth 2020-202

-

COVID-19 IMPACT ON SUPPLY CHAIN DELAYSMARKET FACTOR ANALYSIS

-

Value Chain Analysis/Supply Chain Analysis

-

Porter’s Five Forces Model

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT

-

Introduction

-

Solution

- Cloud Security Posture Management (CSPM)

- Infrastructure-as-Code (IaC) Scanning

- Cloud Workload Protection Platform (CWPP)

- Cloud Service Network Security (CSNS)

- Cloud Infrastructure Entitlement Management (CIEM)

-

Services

- Professional Services

- Managed Services

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE

-

Introduction

-

SMEs

-

Large Enterprises

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL

-

Introduction

-

Retail

-

BFSI

-

Healthcare

-

Government

-

IT & Telecom

-

Manufacturing

-

Others

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET SIZE ESTIMATION & FORECAST, BY REGION

-

Introduction

-

North America

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Component, 2018-2032

- Market Estimates & Forecast, by Organization Size, 2018-2032

- Market Estimates & Forecast, By Industry Vertical, 2018-2032

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Component, 2018-2032

- Market Estimates & Forecast, by Organization Size, 2018-2032

- Market Estimates & Forecast, By Industry Vertical, 2018-2032

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Component, 2018-2032

- Market Estimates & Forecast, by Organization Size, 2018-2032

- Market Estimates & Forecast, By Industry Vertical, 2018-2032

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Forecast, by Component, 2018-2032

- Market Estimates & Forecast, by Organization Size, 2018-2032

- Market Estimates & Forecast, By Industry Vertical, 2018-2032

- Middle East

- Africa

- Latin America

-

COMPETITIVE LANDSCAPE

-

Introduction

-

Key Developments & Growth Strategies

-

Competitor Benchmarking

-

Vendor Share Analysis, 2022(% Share)

-

COMPANY PROFILES

-

Palo Alto Networks

-

Check Point Software Technologies

-

Fortinet

-

Trend Micro

-

Cloudflare

-

Akamai Technologies

-

Imperva

-

F5 Networks

-

Barracuda Networks

-

Zscaler

-

Radware

-

Qualys Inc.

-

Gen Digital Inc.

-

Proofpoint

-

CrowdStrike

-

Sophos

-

McAfee

- Company Overview

- Financial Overview

- Solution/Organization Sizes Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

LIST OF TABLES

-

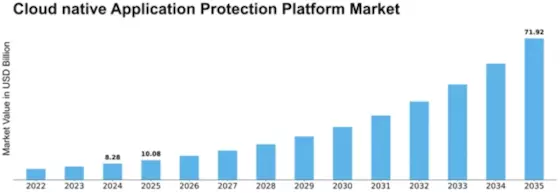

MARKET SYNOPSIS 19

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 52

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 55

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 57

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY REGION, 2018–2032 (USD MILLION) 57

-

NORTH AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2018–2032 (USD MILLION) 61

-

NORTH AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 63

-

NORTH AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 64

-

NORTH AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 65

-

US CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 66

-

US CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 66

-

US CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 68

-

CANADA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 68

-

CANADA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 68

-

CANADA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 68

-

MEXICO CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 70

-

MEXICO CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 71

-

MEXICO CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 71

-

EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2018–2032 (USD MILLION) 71

-

EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 73

-

EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 74

-

EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 74

-

UK CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 74

-

UK CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 77

-

UK CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 78

-

GERMANY CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 79

-

GERMANY CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 80

-

GERMANY CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 80

-

FRANCE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 81

-

FRANCE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 82

-

FRANCE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 82

-

SPAIN CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 82

-

SPAIN CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 85

-

SPAIN CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 85

-

ITALY CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 85

-

ITALY CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 85

-

ITALY CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 87

-

REST OF EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 88

-

REST OF EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 88

-

REST OF EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 88

-

ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2018–2032 (USD MILLION) 90

-

ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 90

-

ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 91

-

ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 91

-

CHINA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 92

-

CHINA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 93

-

CHINA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 93

-

JAPAN CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 93

-

JAPAN CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 95

-

JAPAN CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 96

-

INDIA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 96

-

INDIA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 96

-

INDIA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 99

-

SOUTH KOREA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 100

-

SOUTH KOREA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 101

-

SOUTH KOREA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 102

-

REST OF ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 102

-

REST OF ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 103

-

REST OF ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 104

-

REST OF THE WORLD CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2018–2032 (USD MILLION) 104

-

REST OF THE WORLD CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 104

-

REST OF THE WORLD CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 105

-

REST OF THE WORLD CAMERA MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 106

-

MIDDLE EAST CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 106

-

MIDDLE EAST CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 106

-

MIDDLE EAST CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 108

-

AFRICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 109

-

AFRICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 109

-

AFRICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 109

-

LATIN AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2018–2032 (USD MILLION) 111

-

LATIN AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2018–2032 (USD MILLION) 111

-

LATIN AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2018–2032 (USD MILLION) 112

-

BUSINESS EXPANSIONS/PRODUCT LAUNCHES 112

-

PARTNERSHIPS/AGREEMENTS/CONTRACTS/COLLABORATIONS 113

-

ACQUISITIONS/MERGERS 114

-

PALO ALTO NETWORKS: PRODUCTS OFFERED 115

-

PALO ALTO NETWORKS: KEY DEVELOPMENT 115

-

CHECK POINT SOFTWARE TECHNOLOGIES: PRODUCTS OFFERED 117

-

CHECK POINT SOFTWARE TECHNOLOGIES: KEY DEVELOPMENT 119

-

FORTINET: PRODUCTS OFFERED 120

-

FORTINET: KEY DEVELOPMENT 120

-

TREND MICRO INCORPORATED: PRODUCTS OFFERED 122

-

TREND MICRO INCORPORATED: KEY DEVELOPMENT 123

-

CLOUDFLARE: PRODUCTS OFFERED 124

-

CLOUDFLARE: KEY DEVELOPMENT 124

-

AKAMAI TECHNOLOGIES: PRODUCTS OFFERED 128

-

AKAMAI TECHNOLOGIES: KEY DEVELOPMENT 130

-

IMPERVA: PRODUCTS OFFERED 135

-

IMPERVA: KEY DEVELOPMENT 138

-

F5 NETWORKS. : PRODUCTS OFFERED 139

-

F5 NETWORKS. : KEY DEVELOPMENT 142

-

BARRACUDA NETWORKS: PRODUCTS OFFERED 143

-

BARRACUDA NETWORKS: KEY DEVELOPMENT 146

-

ZSCALER: PRODUCTS OFFERED 147

-

ZSCALER: KEY DEVELOPMENT 150

-

RADWARE: PRODUCTS OFFERED 151

-

RADWARE: KEY DEVELOPMENT 154

-

QUALYS INC.: PRODUCTS OFFERED 154

-

QUALYS INC.: KEY DEVELOPMENT 158

-

GEN DIGITAL INC.: PRODUCTS OFFERED 158

-

GEN DIGITAL INC.: KEY DEVELOPMENT 161

-

PROOFPOINT : PRODUCTS OFFERED 161

-

PROOFPOINT : KEY DEVELOPMENT 165

-

CROWDSTRIKE: PRODUCTS OFFERED 161

-

CROWDSTRIKE: KEY DEVELOPMENT 165

-

SOPHOS: PRODUCTS OFFERED 161

-

SOPHOS: KEY DEVELOPMENT 165

-

MCAFEE: PRODUCTS OFFERED 161

-

MCAFEE: KEY DEVELOPMENT 165

-

-

LIST OF FIGURES

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET 20

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET: MARKET STRUCTURE 22

-

BOTTOM-UP AND TOP-DOWN APPROACHES 27

-

NORTH AMERICA: CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET SIZE (USD MILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032) 30

-

EUROPE: CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET SIZE (USD MILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032) 30

-

ASIA–PACIFIC: CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET SIZE (USD MILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032) 31

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET SIZE (USD MILLION) & MARKET SHARE (%), BY COMPONENT (2022 VS 2032) 32

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET SIZE (USD MILLION) & MARKET SHARE (%), BY ORGANIZATION SIZE (2022 VS 2032) 32

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET SIZE (USD MILLION) & MARKET SHARE (%), BY INDUSTRY VERTICAL (2022 VS 2032) 33

-

MARKET DYNAMIC ANALYSIS OF THE GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET 34

-

DRIVER IMPACT ANALYSIS 34

-

RESTRAINT IMPACT ANALYSIS 35

-

VALUE CHAIN: GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET 37

-

PORTER''S FIVE FORCES ANALYSIS OF THE GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET 37

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2022 (% SHARE) 43

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2022 VS 2032 (USD MILLION) 45

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2022 (% SHARE) 48

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2022 VS 2032 (USD MILLION) 48

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2022 (% SHARE) 51

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2022 VS 2032 (USD MILLION) 51

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY REGION, 2022 (% SHARE) 54

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY REGION, 2022 VS 2032 (USD MILLION) 54

-

NORTH AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2022 (% SHARE) 56

-

NORTH AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2022 VS 2032 (USD MILLION) 56

-

NORTH AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2022-2032 (USD MILLION) 56

-

NORTH AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2022-2032 (USD MILLION) 56

-

NORTH AMERICA CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2022-2032 (USD MILLION) 56

-

EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2022 (% SHARE) 60

-

EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2022 VS 2032 (USD MILLION) 62

-

EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2022-2032 (USD MILLION) 62

-

EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2022-2032 (USD MILLION) 63

-

EUROPE CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2022-2032 (USD MILLION) 64

-

ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2022 (% SHARE) 65

-

ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2022 VS 2032 (USD MILLION) 65

-

ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2022-2032 (USD MILLION) 65

-

ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2022-2032 (USD MILLION) 65

-

ASIA-PACIFIC CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2022-2032 (USD MILLION) 76

-

REST OF THE WORLD CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2022 (% SHARE) 77

-

REST OF THE WORLD CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COUNTRY, 2022 VS 2032 (USD MILLION) 78

-

REST OF THE WORLD CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY COMPONENT, 2022-2032 (USD MILLION) 79

-

REST OF THE WORLD CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY ORGANIZATION SIZE, 2022-2032 (USD MILLION) 80

-

REST OF THE WORLD CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET, BY INDUSTRY VERTICAL, 2022-2032 (USD MILLION) 80

-

GLOBAL CLOUD-NATIVE APPLICATION PROTECTION PLATFORM (CNAPP) MARKET: COMPETITIVE BENCHMARKING 80

-

VENDOR SHARE ANALYSIS (2022) (%) 98

-

PALO ALTO NETWORKS: FINANCIAL OVERVIEW SNAPSHOT 99

-

PALO ALTO NETWORKS: SWOT ANALYSIS 100

-

CHECK POINT SOFTWARE TECHNOLOGIES: FINANCIAL OVERVIEW SNAPSHOT 101

-

CHECK POINT SOFTWARE TECHNOLOGIES: SWOT ANALYSIS 101

-

FORTINET: FINANCIAL OVERVIEW SNAPSHOT 101

-

FORTINET: SWOT ANALYSIS 101

-

TREND MICRO INCORPORATED: FINANCIAL OVERVIEW SNAPSHOT 117

-

TREND MICRO INCORPORATED: SWOT ANALYSIS 118

-

CLOUDFLARE: FINANCIAL OVERVIEW SNAPSHOT 119

-

CLOUDFLARE: SWOT ANALYSIS 119

-

AKAMAI TECHNOLOGIES: FINANCIAL OVERVIEW SNAPSHOT 119

-

AKAMAI TECHNOLOGIES: SWOT ANALYSIS 122

-

IMPERVA: FINANCIAL OVERVIEW SNAPSHOT 123

-

IMPERVA: SWOT ANALYSIS 124

-

F5 NETWORKS. : FINANCIAL OVERVIEW SNAPSHOT 125

-

F5 NETWORKS. : SWOT ANALYSIS 126

-

BARRACUDA NETWORKS: FINANCIAL OVERVIEW SNAPSHOT 127

-

BARRACUDA NETWORKS: SWOT ANALYSIS 128

-

ZSCALER: FINANCIAL OVERVIEW SNAPSHOT 129

-

ZSCALER: SWOT ANALYSIS 130

-

RADWARE: FINANCIAL OVERVIEW SNAPSHOT 131

-

RADWARE: SWOT ANALYSIS 132

-

QUALYS INC.: FINANCIAL OVERVIEW SNAPSHOT 133

-

QUALYS INC.: SWOT ANALYSIS 134

-

GEN DIGITAL INC.: FINANCIAL OVERVIEW SNAPSHOT 135

-

GEN DIGITAL INC.: SWOT ANALYSIS 136

-

PROOFPOINT : FINANCIAL OVERVIEW SNAPSHOT 137

-

PROOFPOINT : SWOT ANALYSIS 138

-

CROWDSTRIKE: FINANCIAL OVERVIEW SNAPSHOT 137

-

CROWDSTRIKE: SWOT ANALYSIS 138

-

SOPHOS: FINANCIAL OVERVIEW SNAPSHOT 137

-

SOPHOS: SWOT ANALYSIS 138

-

MCAFEE: FINANCIAL OVERVIEW SNAPSHOT 137

-

MCAFEE: SWOT ANALYSIS 138

-

-

NOTE:

-

This table of content is tentative and subject to change as the research progresses.

-

In section 14, only the top 15 companies will be profiled. Each company will be profiled based on the Market Overview, Financials, Organization Size Portfolio, Business Strategies, and Recent Developments parameters.

-

The companies are selected based on two broad criteria¬– strength of Component portfolio and excellence in business strategies.

-

Key parameters considered for evaluating strength of the vendor’s Component portfolio are industry experience, Component capabilities/features, innovations/R&D investment, flexibility to customize the Component, ability to integrate with other systems, pre- and post-sale Organization Sizes, and customer ratings/feedback.

-

Key parameters considered for evaluating a vendor’s excellence in business strategy are its market share, global presence, customer base, partner ecosystem (Organization Size alliances/resellers/distributors), acquisitions, and marketing strategies/investments.

-

The financial details of the company cannot be provided if the information is not available in the public domain and or from reliable sources.

Leave a Comment