The Cloud ERP Market is currently experiencing a transformative phase characterized by rapid technological advancements and evolving business needs. Organizations are increasingly adopting cloud-based solutions to enhance operational efficiency, streamline processes, and improve data accessibility. This shift is driven by the desire for flexibility, scalability, and cost-effectiveness, as businesses seek to adapt to changing market dynamics.

Furthermore, the integration of artificial intelligence and machine learning into cloud ERP systems is reshaping how companies manage resources, analyze data, and make informed decisions. As a result, the Cloud ERP Market is poised for substantial growth, with a focus on delivering innovative solutions that cater to diverse industry requirements. Major cloud ERP vendors such as SAP, Oracle, and Microsoft dominate the competitive landscape. An ERP cloud solution offers flexibility, scalability, and reduced infrastructure costs compared to on-premise systems. Deploying ERP in the cloud allows enterprises to access real-time data across distributed teams. Organizations are increasingly migrating ERP systems to cloud-based environments to improve agility.

In addition to technological advancements, the Cloud ERP Market is witnessing a growing emphasis on security and compliance. Organizations are prioritizing data protection and regulatory adherence, leading to the development of robust security features within cloud ERP solutions. This trend reflects a broader awareness of the importance of safeguarding sensitive information in an increasingly digital landscape. Moreover, the rise of remote work and global collaboration is further propelling the demand for cloud-based ERP systems, as businesses seek to enable seamless communication and coordination across geographically dispersed teams. Overall, the Cloud ERP Market appears to be on a trajectory of continuous evolution, driven by the interplay of technology, security, and changing workforce dynamics.

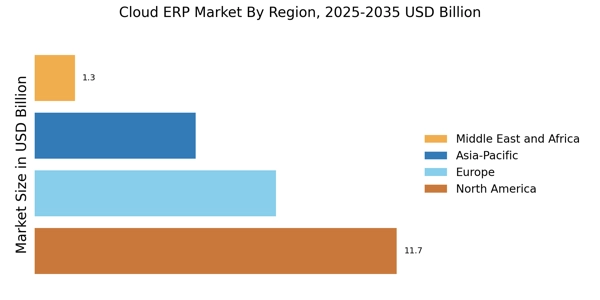

The enterprise resource planning market is undergoing rapid digital transformation, with cloud-based ERP solutions gaining widespread adoption. Public cloud deployment accounted for a significant ERP market share in 2024 due to scalability and cost efficiency. Regional ERP market shares vary significantly based on digital maturity and cloud adoption rates. This ERP industry report provides a comprehensive assessment of market trends, segmentation, and competitive dynamics through 2035.

Increased Adoption of AI and Automation

The Cloud ERP Market is witnessing a notable trend towards the integration of artificial intelligence and automation technologies. Businesses are leveraging these advancements to enhance operational efficiency, reduce manual tasks, and improve decision-making processes. This trend indicates a shift towards more intelligent systems that can analyze data in real-time, providing insights that drive strategic initiatives. Modern cloud ERP applications support financial management, supply chain optimization, and human resource planning. An integrated cloud ERP suite enables organizations to manage core business functions through a unified platform. Leading cloud ERP providers are expanding AI-driven features to improve automation and analytics.

Focus on Data Security and Compliance

As organizations increasingly migrate to cloud-based solutions, there is a heightened focus on data security and regulatory compliance within the Cloud ERP Market. Companies are prioritizing the implementation of advanced security measures to protect sensitive information and ensure adherence to industry regulations. This trend reflects a growing awareness of the risks associated with data breaches and the need for robust security frameworks. The ERP software market is witnessing steady growth due to increasing cloud adoption across industries. Cloud-based deployments now account for a growing ERP software market share globally. Demand for ERP software in the cloud is increasing as businesses prioritize remote access and scalability.

Remote Work and Global Collaboration

The rise of remote work has significantly influenced the Cloud ERP Market, as businesses seek solutions that facilitate collaboration among distributed teams. Cloud-based ERP systems are becoming essential tools for enabling seamless communication and project management across various locations. This trend highlights the necessity for flexible and accessible systems that support a modern workforce. Large enterprises continue to dominate ERP systems market share due to higher implementation budgets. Recent ERP reports indicate rising adoption of cloud-based ERP among SMEs.