Market Share

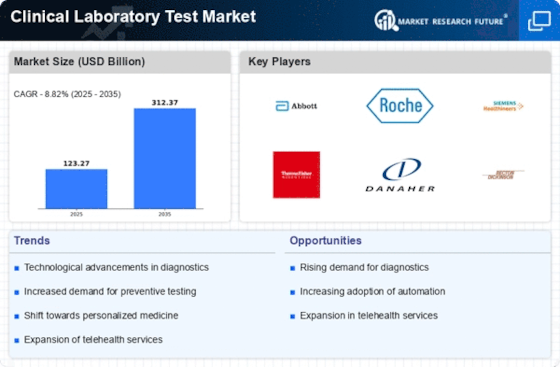

Clinical Laboratory Test Market Share Analysis

In the bustling landscape of the Clinical Laboratory Test Market, companies employ various strategies to establish their presence and secure market share. One of the fundamental strategies revolves around service diversification and specialization. Companies invest significantly in expanding their portfolio of laboratory tests to cover a wide range of medical specialties and diagnostic needs. These may include tests for infectious diseases, cancer screening, genetic testing, hormone analysis, and more. By offering a comprehensive menu of tests, companies can cater to diverse healthcare needs and attract a broader customer base, including healthcare providers, hospitals, clinics, and patients seeking accurate diagnostic solutions.

Pricing strategy is another critical aspect of market share positioning within the Clinical Laboratory Test Market. Some companies opt for competitive pricing strategies, aiming to capture market share by offering tests at lower prices compared to competitors. This approach is particularly effective in regions where healthcare costs are a significant concern, and cost-effective solutions are highly sought after. Conversely, other companies may adopt premium pricing strategies, positioning their tests as high-quality options that offer superior accuracy, reliability, or convenience. This allows them to target customers who prioritize quality and are willing to pay a premium for advanced diagnostic services.

Distribution channels play a vital role in market share positioning. Companies may focus on expanding their network of laboratory facilities or partnering with healthcare institutions, clinics, and hospitals to ensure widespread availability of their tests. Additionally, companies may invest in digital distribution channels, such as telemedicine platforms or online portals, to enhance accessibility and convenience for patients and healthcare providers. By optimizing distribution channels, companies can reach a broader audience and increase their market penetration.

Marketing and branding strategies are essential for building brand recognition and gaining market share in the Clinical Laboratory Test Market. Companies often invest in developing strong brands that are associated with quality, reliability, and accuracy in diagnostic testing. This may involve targeted marketing campaigns, educational initiatives to raise awareness about the importance of laboratory testing, or collaborations with healthcare professionals to promote their services. By positioning themselves as trusted partners in healthcare and emphasizing the benefits of their tests, companies can attract customers and differentiate themselves from competitors.

Strategic partnerships and collaborations are instrumental in expanding market share within the Clinical Laboratory Test Market. Companies may form alliances with pharmaceutical companies, medical device manufacturers, or healthcare organizations to leverage complementary expertise and resources. These partnerships can facilitate collaborative research projects, joint marketing efforts, or co-development of innovative testing solutions. By working together with strategic partners, companies can enhance their capabilities, expand their market reach, and gain a competitive advantage in the laboratory testing landscape.

Furthermore, customer-centric strategies are crucial for gaining market share in the Clinical Laboratory Test Market. Companies must understand the needs and preferences of their customers, including healthcare providers, patients, and payers, and tailor their testing services accordingly. This may involve offering customizable testing panels, providing rapid turnaround times for test results, or implementing user-friendly interfaces for test ordering and result reporting. By focusing on delivering value and enhancing the overall customer experience, companies can build trust and loyalty among customers and maintain a competitive edge in the market.

Regulatory compliance and quality assurance are paramount in the Clinical Laboratory Test Market. Companies must ensure that their tests meet stringent regulatory standards and undergo rigorous validation to ensure accuracy, reliability, and safety. By adhering to regulatory requirements and maintaining high-quality standards, companies can build trust and confidence among customers and stakeholders, which is essential for gaining market share and sustaining long-term success in the Clinical Laboratory Test Market.

Leave a Comment