Increased Focus on Patient Outcomes

The Clinical Documentation Improvement Market is increasingly shaped by a heightened focus on patient outcomes. Healthcare providers are recognizing that accurate clinical documentation is essential for tracking patient progress and improving overall care quality. This shift towards value-based care emphasizes the need for comprehensive documentation that reflects the true complexity of patient cases. As a result, organizations are investing in clinical documentation improvement initiatives to ensure that they can effectively demonstrate the quality of care provided. Market data suggests that healthcare organizations that implement robust documentation practices can see a 15% improvement in patient satisfaction scores. This focus on outcomes not only enhances patient care but also positions organizations favorably in a competitive healthcare landscape.

Technological Advancements in Healthcare

The Clinical Documentation Improvement Market is being propelled by rapid technological advancements within the healthcare sector. Innovations such as artificial intelligence, machine learning, and natural language processing are transforming the way clinical documentation is created and managed. These technologies enable healthcare providers to streamline documentation processes, reduce errors, and enhance the overall quality of clinical records. The integration of advanced technologies is expected to drive market growth, as organizations seek to leverage these tools to improve efficiency and accuracy. For instance, AI-driven solutions can analyze vast amounts of clinical data, providing insights that can lead to better documentation practices. As healthcare continues to embrace digital transformation, the demand for clinical documentation improvement solutions that incorporate these technologies is likely to rise.

Growing Awareness of Healthcare Quality Metrics

The Clinical Documentation Improvement Market is witnessing a surge in awareness regarding healthcare quality metrics. As healthcare systems increasingly adopt performance-based measures, the need for accurate clinical documentation becomes critical. Quality metrics are often tied to reimbursement rates, making it essential for healthcare providers to ensure that their documentation accurately reflects the care delivered. This awareness is driving investments in clinical documentation improvement initiatives, as organizations strive to meet quality benchmarks and enhance their reputations. Market analysis indicates that healthcare providers focusing on documentation improvement can achieve a 25% increase in their quality scores, which can directly impact their financial performance. Consequently, the growing emphasis on quality metrics is likely to sustain the momentum of the clinical documentation improvement market.

Regulatory Compliance and Reimbursement Policies

The Clinical Documentation Improvement Market is significantly influenced by the evolving landscape of regulatory compliance and reimbursement policies. Healthcare organizations are under constant pressure to adhere to stringent regulations set forth by governmental and private payers. Non-compliance can result in substantial financial penalties and loss of reimbursement. As a result, there is a growing recognition of the importance of clinical documentation improvement to meet these regulatory requirements. The market is projected to grow as healthcare providers invest in solutions that enhance documentation accuracy and compliance. In fact, it is estimated that organizations that prioritize clinical documentation improvement can reduce claim denials by up to 30%, thereby ensuring a more stable revenue stream and fostering a culture of accountability within healthcare settings.

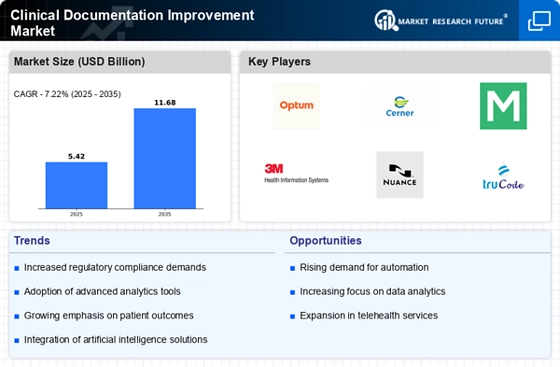

Rising Demand for Accurate Clinical Documentation

The Clinical Documentation Improvement Market is experiencing a notable increase in demand for precise and comprehensive clinical documentation. This trend is largely driven by the need for healthcare providers to enhance patient care and ensure accurate reimbursement from payers. As healthcare systems evolve, the emphasis on quality documentation becomes paramount, with studies indicating that accurate clinical documentation can lead to a 20% increase in revenue for healthcare organizations. Furthermore, regulatory bodies are increasingly scrutinizing documentation practices, which compels healthcare providers to invest in clinical documentation improvement initiatives. This rising demand is expected to propel the market forward, as organizations seek to implement effective strategies that not only improve documentation quality but also optimize operational efficiency.

.png)