Research Methodology on Cleanroom Consumables Market

Introduction

Cleanroom consumables are used in a wide range of industries, from medical and healthcare to research and development. They are a vital part of the cleanroom environment, providing a safe and sterile environment for research, manufacturing and medical operations. This research report examines the cleanroom consumables market from a global perspective. Specifically, the objective of this study is to:

Analyze current cleanroom consumables market trends and expected industry growth.

Investigate trends affecting supply and demand dynamics for cleanroom consumables.

Identify key stakeholders in the cleanroom consumables industry.

Research Methodology

To achieve an in-depth understanding of the global cleanroom consumables market, this research employs a comprehensive research methodology. The research process involved the following steps:

Gathering secondary data: The study began with an extensive literature review on the Cleanroom Consumables Market. Market reports and articles were identified from a variety of sources, including industry publications, academic journals, studies, news publications and other relevant sources.

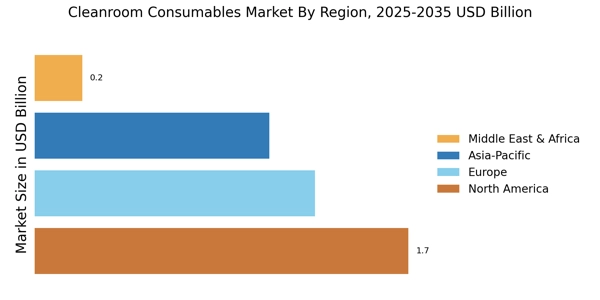

Analyzing existing data: The existing data obtained from the literature review was analyzed to identify current trends and expected industry growth. The data was analyzed by geographical location, application, equipment type and cleanroom consumables type to identify market drivers, restraints and opportunities.

Conducting interviews: Qualitative interviews were conducted with key stakeholders in the Cleanroom Consumables Market to explore emerging trends. We established contacts with industry experts, manufacturers, distributors and other relevant personnel to obtain their views on the market.

Establishing survey: After gathering and analyzing relevant information, a survey was designed to elicit opinions and perspectives on the Cleanroom Consumables Market. The survey was administered through web-based platforms, such as online forums, email and social media. A template was used to generate feedback from the survey participants. We have also conducted a focus group to gain more insights into the Market.

Evaluating data: The data obtained from the survey and interviews were then evaluated to generate insights into the market. Statistical analysis techniques such as regression analysis and cluster analysis were used to evaluate the data.

Generating conclusions: The information from the secondary sources, interviews and surveys was synthesized to generate conclusions on the Cleanroom Consumables Market.

Conclusion

The objective of this study was to analyze the Cleanroom Consumables Market from a global perspective. Our research methodology involved gathering secondary data, analyzing existing data, conducting interviews, establishing surveys, evaluating data and generating conclusions. The results of this study provide an in-depth understanding of the Global Cleanroom Consumables Market, its trends, dynamics, and key stakeholders.