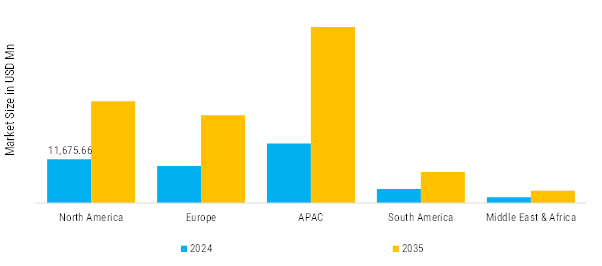

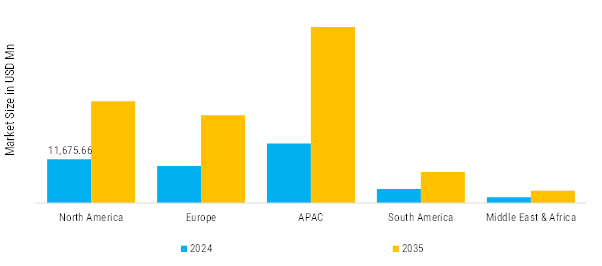

North America: Mature Market with Stable Demand

North America represents a major regional segment within the Cleaning Chemicals Market, driven by strong industrial activity, expanding commercial infrastructure, and high consumer awareness of hygiene and sanitation. The region includes key markets such as the United States, Canada, and Mexico, each exhibiting diverse end-use requirements across industrial, medical, household, and institutional sectors. In the United States, the growth is fueled by stringent regulatory frameworks such as OSHA (Occupational Safety and Health Administration) and EPA (Environmental Protection Agency) guidelines, which mandate the use of high-performance and eco-friendly cleaning chemicals in workplaces, healthcare facilities, and public institutions. Canada demonstrates steady demand across residential and commercial cleaning applications, with increasing adoption of sustainable and biodegradable cleaning products. Mexico is witnessing rising industrial and commercial facility expansions, especially in manufacturing hubs and logistics centers, which are boosting demand for industrial cleaners, floor care products, and multipurpose solutions. The presence of major multinational cleaning chemical manufacturers, advanced supply chain infrastructure, and rising investment in smart facilities and commercial real estate are collectively strengthening market growth in North America. However, the high cost of specialty chemicals and regulatory compliance requirements present certain challenges that require innovation and cost-optimization strategies. Overall, North America remains a key market segment characterized by technological advancements, premium product adoption, and a strong focus on environmental sustainability.

Europe: Balanced Market with Regulatory Influence

Europe accounts for a significant portion of the Cleaning Chemicals Market, underpinned by strict hygiene standards, well-established industrial and healthcare sectors, and rising consumer demand for sustainable cleaning solutions. Key countries such as Germany, France, the United Kingdom, Russia, Italy, Spain, and Rest of Europe collectively drive the market, supported by urbanization, growing commercial establishments, and high penetration of household cleaning products. In Germany and France, industrial and institutional cleaning chemicals are widely utilized in manufacturing, automotive, and pharmaceutical sectors, with an emphasis on eco-friendly formulations and regulatory compliance with REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) guidelines. The United Kingdom and Italy are witnessing growth in commercial office cleaning, retail hygiene, and foodservice applications, driven by increased consumer hygiene awareness and workplace safety protocols. Southern European countries, including Spain and Portugal, show rising demand for multipurpose and household cleaning chemicals due to urbanization and lifestyle changes. Additionally, the adoption of advanced disinfectants, enzymatic cleaners, and sustainable products is supporting market expansion across healthcare, hospitality, and public sectors. The European market is further reinforced by strong R&D investments, well-established distribution networks, and stringent environmental regulations promoting green cleaning practices. Overall, Europe continues to be a high-value regional market for cleaning chemicals, characterized by premium product adoption and sustainability-driven growth.

Asia-Pacific: Largest & Fastest-Growing Region

Asia-Pacific represents a rapidly expanding regional segment within the Cleaning Chemicals Market, driven by industrialization, urbanization, and rising consumer awareness of hygiene and sanitation. The region includes major markets such as China, India, Japan, South Korea, Australia, Malaysia, Thailand, Indonesia, and Rest of APAC, each exhibiting diverse end-use applications across industrial, commercial, household, and institutional sectors. China leads the region with strong demand from manufacturing, food processing, healthcare, and automotive industries, fueled by the expansion of industrial parks, logistics hubs, and commercial facilities. India is witnessing significant growth in household and institutional cleaning chemicals due to urban population expansion, rising disposable incomes, and government initiatives promoting public hygiene and sanitation in urban and rural areas. Japan and South Korea demonstrate high adoption of premium and technologically advanced cleaning products, including disinfectants, enzyme-based detergents, and eco-friendly formulations. Australia and Southeast Asian markets are increasingly focusing on sustainable and multipurpose cleaning solutions, driven by environmental regulations and growing awareness of occupational and public hygiene standards. The APAC region is characterized by rapid market growth, increasing infrastructure investment, and a rising preference for innovative, eco-friendly, and high-performance cleaning chemicals. However, fragmented distribution channels and varying regulatory frameworks across countries present challenges that require careful market strategies. Overall, APAC is poised to become a dominant regional growth hub for the Cleaning Chemicals Market, supported by industrial growth, urbanization, and evolving consumer preferences.

South America: Emerging Market

South America represents an emerging market within the global cleaning chemicals landscape, supported by industrial expansion, urban infrastructure development, and growing consumer awareness of hygiene and sanitation. Key markets include Brazil, Argentina, and Rest of South America, each contributing to demand across industrial, commercial, and household segments. Brazil, as the largest market in the region, is witnessing increased adoption of industrial cleaners, disinfectants, and household cleaning products due to expansion in manufacturing, food processing, and retail sectors. Argentina and Chile are experiencing steady growth in commercial cleaning applications and institutional hygiene products, driven by urbanization, infrastructure projects, and public health initiatives. The market is further supported by rising investment in modern commercial real estate, hospitality facilities, and educational institutions, which require high-performance and eco-friendly cleaning solutions. Innovations in biodegradable formulations, low-VOC products, and concentrated chemical solutions are gaining traction among environmentally conscious consumers. Despite challenges such as economic volatility and regulatory heterogeneity, South America remains a growth-oriented regional segment, with increasing adoption of both industrial and household cleaning chemicals across diverse applications.

Middle East & Africa: Emerging Market with High Potential

The Middle East and Africa region represents a strategically important segment of the Cleaning Chemicals Market, characterized by growing industrialization, urban development, and increasing hygiene awareness in both public and private sectors. Key markets include Saudi Arabia, the United Arab Emirates, South Africa, Egypt, and Nigeria, where demand spans industrial, commercial, healthcare, and household applications. The region’s growth is driven by rapid urbanization, large-scale infrastructure projects, expansion of hospitality and retail sectors, and rising government focus on public health and sanitation. In the Gulf Cooperation Council (GCC) countries, high-end commercial offices, luxury hotels, and healthcare facilities are increasingly adopting technologically advanced cleaning chemicals, including disinfectants, enzymatic cleaners, and eco-friendly formulations. South Africa and Egypt demonstrate steady growth in industrial and household cleaning products, supported by urban population expansion and improving sanitation standards. The MEA region is further witnessing innovations in multipurpose cleaning chemicals, biodegradable solutions, and high-efficacy disinfectants tailored for diverse climatic conditions and usage scenarios. While logistical challenges, regulatory inconsistencies, and price sensitivity remain factors affecting market expansion, MEA continues to hold strategic importance for cleaning chemical manufacturers, offering significant growth opportunities across industrial, commercial, and residential applications.