Market Share

Chronic Idiopathic Constipation Market Share Analysis

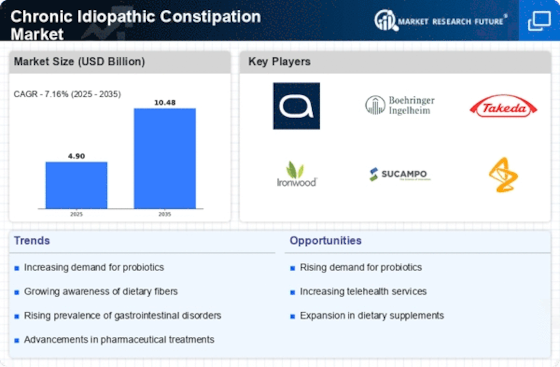

Among the integral domains in gastrointestinal healthcare is Chronic Idiopathic Constipation (CIC) market, which is grappling with stiffer competition that has necessitated different market share positioning strategies by firms. Furthermore, businesses’ success and sustainability within this dynamic environment depend on effective strategies for success in CIC market. Investing in research and development to introduce innovative therapies and treatment options is an important way of moving forward with this strategy. By offering advanced medications and treatments, companies seek to differentiate themselves for better management of chronic idiopathic constipation conditions characterized by persistent, difficult-to-treat constipation without a known cause. This strategic approach meets the rising demand for accurate and efficient solutions facilitating such unique challenges as perennial constipation.

The pricing strategies play a role in determining the market share within Chronic idiopathic constipation market. Companies often use various pricing models like premium pricing for medication with added benefits as well as affordable options to increase patients’ accessibility. They price their products based on their perceived value that would cater for different markets such as hospital looking forward to state-of-the-art solutions or countries having different economic situations. For instance, through flexible pricing model they are able to be accessible throughout any given market thus broadening their reach.

Strategic collaborations and partnerships are key drivers in market share positioning for the CIC market. Collaborative projects involving these entities enhance knowledge sharing while at the same time putting diagnosis and treatment options into limelight. On one hand, these organizations exploit their partners’ strengths so as to gain competitive advantage in terms of research capabilities, marketing insights or distribution networks thus shoring up their overall presence.

Another important strategy used by companies is segmenting the customer base so that they can effectively target diverse groups within the Chronic Idiopathic Constipation (CIC) market. Medications tailored specifically towards meeting specific challenges faced by gastroenterologists, primary care physicians and patients suffering from CIC tend to have greater acceptability and usage by target markets. Different marketing mix strategies coupled with product portfolios are then developed to suit the unique requirements of these segments, thus enhancing their market position.

The positioning of companies’ market shares is significantly influenced by patient-centered approaches such as comprehensive support programs for patients and educational activities. Companies that offer assistance services, training resources and convenient communication measures targeting at satisfying patients or medical service providers are more likely to gain trust and loyalty from their stakeholders. This way, a company can have an increasing number of satisfied customers who would not only advocate for it but also recommend it to other potential customers thereby affecting its market share positively.

Leave a Comment