Advancements in Polymer Technology

Technological advancements in polymer science are enhancing the properties and applications of chlorinated polyethylene, making it more versatile and appealing to various industries. Innovations in production techniques are leading to improved performance characteristics, such as increased tensile strength and better thermal stability. This evolution is crucial for the Global Chlorinated Polyethylene Market Industry, as it opens new avenues for application in sectors like electronics and consumer goods. The ability to tailor the properties of chlorinated polyethylene to meet specific industry needs may further stimulate market growth, potentially resulting in a more competitive landscape.

Growing Demand in Automotive Sector

The automotive industry is witnessing a notable increase in the utilization of chlorinated polyethylene, primarily due to its excellent resistance to heat, oil, and chemicals. This trend is particularly evident in the production of automotive parts and components, where durability and performance are paramount. As the Global Chlorinated Polyethylene Market Industry expands, it is projected that the automotive segment will significantly contribute to the overall market growth, potentially reaching a valuation of 4.07 USD Billion in 2024. The increasing focus on lightweight materials and fuel efficiency in vehicles further drives this demand, indicating a robust future for chlorinated polyethylene in automotive applications.

Rising Applications in Construction

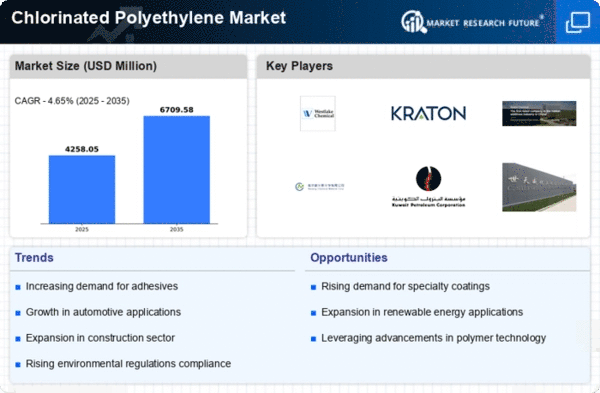

Chlorinated polyethylene is increasingly being adopted in the construction sector, particularly in roofing membranes and waterproofing applications. Its superior weather resistance and longevity make it an ideal choice for various construction materials. The Global Chlorinated Polyethylene Market Industry is likely to benefit from the ongoing urbanization and infrastructure development across the globe. As cities expand and the demand for durable construction materials rises, the market for chlorinated polyethylene is expected to grow. By 2035, the market could reach an estimated value of 6.71 USD Billion, reflecting a compound annual growth rate of 4.65% from 2025 to 2035.

Expanding Use in Medical Applications

The medical sector is increasingly recognizing the benefits of chlorinated polyethylene, particularly in the production of medical devices and equipment. Its biocompatibility and resistance to various chemicals make it suitable for applications in healthcare. The Global Chlorinated Polyethylene Market Industry is expected to experience growth as the demand for high-quality medical products rises. With an aging population and increasing healthcare needs, the potential for chlorinated polyethylene in medical applications appears promising. This trend may lead to further innovations and enhancements in product offerings, thereby expanding the market's reach.

Environmental Regulations Favoring Chlorinated Polyethylene

Stringent environmental regulations are pushing industries to adopt materials that are less harmful to the environment. Chlorinated polyethylene, known for its recyclability and lower environmental impact compared to other polymers, is gaining traction in this context. The Global Chlorinated Polyethylene Market Industry is likely to see increased adoption as companies seek to comply with these regulations while maintaining product performance. This shift towards sustainable materials may not only enhance the market's reputation but also drive growth as more industries prioritize eco-friendly solutions in their operations.