Market Trends

Introduction

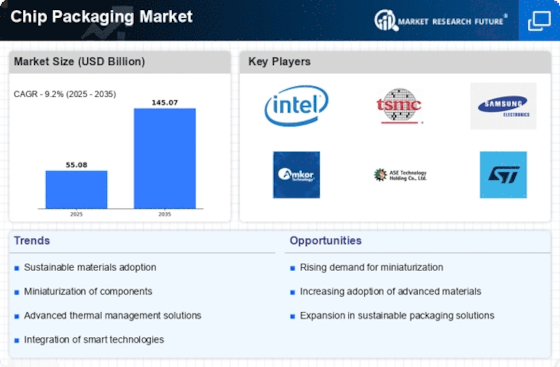

During the years between now and 2024, the chip packaging market will be going through a major change, influenced by a confluence of macroeconomic factors. Technological progress, especially in miniaturization and integration, is transforming the chip packaging solutions needed to meet the needs of the ever-more complex semiconductor applications. The pressures of the regulatory framework are pushing the industry to adopt more eco-friendly materials and processes, while the trend towards more intelligent and efficient devices is pushing innovation in chip packaging. These trends are strategically important for the industry’s players, because they not only influence their competitive positioning but also direct the future direction of product development and the dynamics of the market.

Top Trends

-

Advanced Packaging Technologies

Leading manufacturers are driving the move towards advanced packaging techniques like 3D and system-in-package (SiP). These will improve performance and reduce space requirements. By 2025, 3D packaging is expected to represent 30% of the market. This trend is critical for the demands of HPC and IoT applications. And as companies invest in research and development, operational efficiencies will improve and costs will come down. -

Sustainability Initiatives

The emphasis on the environment is a growing trend. Companies such as ASE Group are adopting more eco-friendly materials and processes. The drive to reduce carbon emissions has resulted in a 20 per cent increase in demand for sustainable packaging. This trend has also been influenced by governments’ regulatory requirements, which have prompted companies to look for new solutions. Biodegradable materials could be the next big thing, which will have a major impact on the way companies operate and on supply chains. -

Miniaturization of Components

Miniaturization is a process that is now well advanced, and the chip industry is now striving to produce ever smaller and more efficient designs. Broadcom leads the way, and it is estimated that demand for smaller chip packages is growing at a rate of 15 per cent per year. This trend is essential for mobile devices and wearables, where space is at a premium. Miniaturization may even lead to a new design and manufacturing paradigm. -

Increased Focus on Reliability

Reliability in chip packaging is becoming more and more important, especially in the automotive and aeronautics industries. The leaders are introducing more rigorous testing, and the reliability of the products is said to have increased by up to 25%. The focus on reliability is driven by the need for security in critical applications. In the future, this could result in stricter regulations and higher quality assurance costs. -

Integration of AI and Automation

AI and automation in chip-packaging processes are transforming production. Using AI to predict when a machine will break down has resulted in a 30% reduction in downtime at a company like TI. This trend will boost efficiency and reduce costs. We can expect more automation as AI technology advances. This will result in a smarter factory. -

Rise of 5G and IoT Applications

The emergence of 5G and IoT applications is driving the need for advanced chip packaging. Unimicron has seen a 40 percent increase in orders for 5G-related chip packaging. The higher data rates and higher data densities call for new designs to accommodate the shift. And the 5G-related developments could have an impact on future production strategies. -

Global Supply Chain Resilience

The COVID pandemic has exposed the fragility of the world's supply chains. Companies are now working to improve resilience. Leaders are diversifying their suppliers. They are launching initiatives to source local raw materials, and they are boosting their local production by 20 per cent. This is a crucial step to reduce risk and maintain continuity of supply. In the long run, this could lead to a shift towards regional production centres, with implications for logistics and operational strategies. -

Emergence of Hybrid Packaging Solutions

A combination of different materials and different techniques is gaining ground. The American company Amkor is one of the forerunners in this field, and it is a reported that its hybrid package production increased by 15 percent in the last year. This trend leads to higher performance and more design flexibility. As hybrids become more popular, it is likely that material procurement and production methods will change. -

Enhanced Thermal Management Solutions

With the increasing power density of the chips, it is becoming increasingly important to have a higher performance of heat dissipation. Companies like Powertech are developing advanced thermal interface materials that improve heat dissipation by up to 25%. This trend is essential for high-performance applications, especially in the areas of computing and the automobile. Further developments could focus on novel materials that further improve the thermal performance. -

Collaboration and Partnerships

During this period, the collaboration between the industry players increased significantly. For example, the recent collaborations led to a thirty percent increase in the number of joint research and development projects. This trend encourages innovation and accelerates the development of new technologies. The next step could be closer integration of supply chains and shared use of resources, which would change the industry's competitive dynamics.

Conclusion: Navigating the Chip Packaging Landscape

The chip-packaging market in 2024 will be characterized by a highly competitive and fragmented market, where both the incumbents and the new entrants will compete for market share. The geographical trends point to a shift in manufacturing towards Asia-Pacific, while North America and Europe will focus on innovation and environment. Strategic positioning will be based on a combination of advanced capabilities such as artificial intelligence, automation and sustainable practices, to improve efficiency and meet the needs of the consumers. The flexibility of the production processes will be a decisive factor in the adaptation to the rapid technological changes and the preferences of the consumers in the future.

Leave a Comment