Emergence of IoT Applications

The emergence of Internet of Things (IoT) applications is significantly influencing the wireless telecommunication-service market in China. With an estimated 1 billion connected devices expected by 2025, the demand for reliable and high-speed wireless connectivity is surging. This trend is prompting telecommunications companies to develop specialized services tailored for IoT applications, such as smart cities and connected vehicles. The integration of IoT into everyday life is likely to create new revenue streams for service providers, thereby driving growth in the wireless telecommunication-service market. This shift towards IoT is indicative of a broader transformation within the telecommunications landscape.

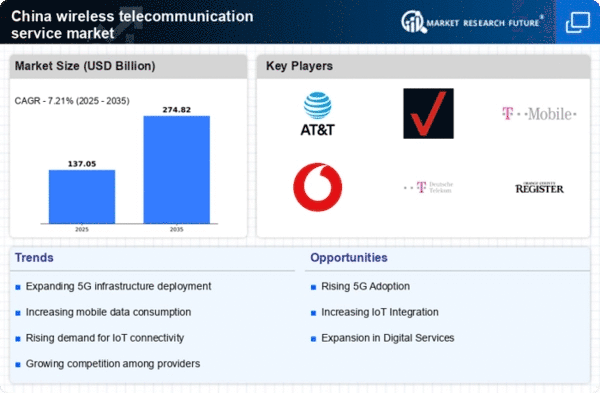

Rising Mobile Data Consumption

In recent years, the wireless telecommunication-service market has witnessed a significant increase in mobile data consumption in China. Reports indicate that mobile data traffic is projected to grow by over 30% annually, driven by the proliferation of smartphones and mobile applications. This surge in demand is compelling service providers to enhance their offerings and invest in more robust network capabilities. Consequently, the competition among providers is intensifying, leading to better pricing strategies and service packages for consumers. This dynamic environment is expected to further stimulate growth in the wireless telecommunication-service market.

Government Policies and Regulations

Government policies play a crucial role in shaping the wireless telecommunication-service market in China. The Chinese government has implemented various regulations aimed at promoting competition and innovation within the sector. For instance, the recent policy initiatives to reduce licensing fees and streamline the approval process for new technologies are likely to encourage more players to enter the market. Additionally, the government's commitment to expanding rural connectivity is expected to open new avenues for growth, as it aims to bridge the digital divide. These regulatory frameworks are essential for fostering a conducive environment for the wireless telecommunication-service market.

Increased Investment in Cybersecurity

As the wireless telecommunication-service market expands, the importance of cybersecurity has become increasingly apparent. With the rise in data breaches and cyber threats, service providers in China are investing heavily in cybersecurity measures. It is estimated that spending on cybersecurity solutions in the telecommunications sector could reach $10 billion by 2026. This focus on security not only protects consumer data but also enhances trust in wireless services. As a result, consumers are more likely to engage with providers that prioritize cybersecurity, thereby positively impacting the overall growth of the wireless telecommunication-service market.

Technological Advancements in Infrastructure

The wireless telecommunication-service market in China is experiencing rapid technological advancements, particularly in infrastructure development. The rollout of 5G technology has been a pivotal factor, with investments exceeding $50 billion in 2025 alone. This investment is aimed at enhancing network capacity and speed, which is crucial for supporting the increasing demand for mobile data. Furthermore, the integration of artificial intelligence and machine learning in network management is streamlining operations and improving service delivery. As a result, the wireless telecommunication-service market is likely to see a surge in user adoption and satisfaction, driven by these innovations.