Growing Focus on Cost Efficiency

Cost efficiency remains a critical driver in the web scale-it market in China. As organizations strive to optimize their operational expenditures, there is a growing emphasis on adopting cost-effective IT solutions. Businesses are increasingly turning to web scale-it architectures that allow for better resource allocation and management. This shift is particularly evident in sectors such as retail and finance, where companies are leveraging scalable IT solutions to reduce overhead costs while enhancing service delivery. Recent studies indicate that companies implementing web scale-it strategies can achieve up to 30% savings in IT expenditures. This focus on cost efficiency is likely to propel the web scale-it market forward, as more organizations recognize the financial benefits of adopting scalable and flexible IT infrastructures.

Emergence of Hybrid Cloud Solutions

The emergence of hybrid cloud solutions is reshaping the landscape of the web scale-it market in China. Organizations are increasingly adopting hybrid models that combine on-premises infrastructure with cloud services, allowing for greater flexibility and control over their IT environments. This trend is driven by the need for businesses to balance data security and compliance with the agility offered by cloud solutions. As of November 2025, it is estimated that over 40% of enterprises in China are utilizing hybrid cloud strategies, reflecting a significant shift in IT deployment models. The web scale-it market is likely to benefit from this trend, as hybrid solutions provide the scalability required to meet growing demands while ensuring that sensitive data remains secure and compliant with local regulations.

Increased Investment in Data Centers

Investment in data centers is a pivotal driver for the web scale-it market in China. As the demand for digital services continues to rise, companies are increasingly investing in building and upgrading data center facilities to support their IT operations. This trend is fueled by the need for enhanced data processing capabilities and storage solutions. Recent reports suggest that the data center market in China is expected to reach $20 billion by 2026, with a substantial portion allocated to web scale-it solutions. This influx of capital is likely to accelerate the development of advanced data center technologies, including energy-efficient designs and high-density computing. Consequently, the web scale-it market stands to gain from these investments, as organizations seek to enhance their infrastructure to accommodate growing data needs.

Rising Demand for Scalable Infrastructure

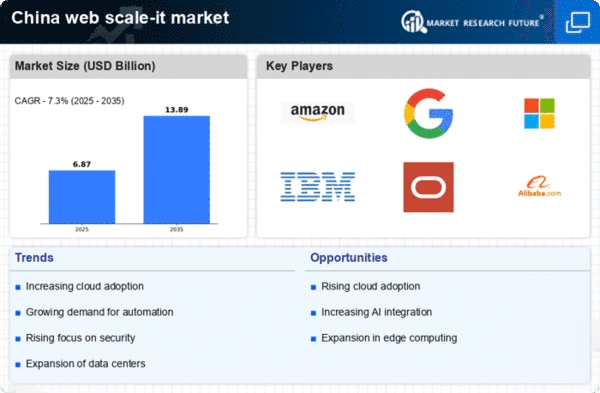

The web scale-it market in China is experiencing a notable surge in demand for scalable infrastructure. As businesses increasingly migrate to digital platforms, the need for flexible and efficient IT resources becomes paramount. This trend is driven by the rapid growth of e-commerce and online services, which require robust infrastructure to handle fluctuating traffic and data loads. According to recent data, the market for scalable IT solutions in China is projected to grow at a CAGR of 15% over the next five years. This growth is indicative of a broader shift towards cloud-based services, where companies seek to optimize their operations and reduce costs. Consequently, The web scale-it market is likely to benefit from this increasing demand for scalable solutions as organizations prioritize agility and responsiveness in their IT strategies.

Government Initiatives Supporting Digital Transformation

In China, government initiatives aimed at promoting digital transformation are significantly impacting the web scale-it market. The Chinese government has launched various programs to encourage the adoption of advanced technologies, including cloud computing and big data analytics. These initiatives are designed to enhance the competitiveness of Chinese enterprises on a global scale. For instance, the 'Made in China 2025' plan emphasizes the integration of IT and manufacturing, which is expected to drive investments in scalable IT infrastructure. As a result, The web scale-it market is likely to see increased funding and support from both public and private sectors, which will foster innovation and growth in this space. The government's commitment to digitalization suggests a favorable environment for the expansion of web scale-it solutions across various industries.