Aging Population

China's demographic shift towards an aging population is significantly impacting the vitamins minerals-supplement market. As the proportion of elderly individuals increases, there is a heightened focus on health maintenance and disease prevention. Older adults often require specific vitamins and minerals to support their health, which drives demand for targeted supplements. According to recent statistics, the population aged 60 and above is expected to exceed 300 million by 2035, creating a substantial market opportunity. This demographic trend indicates that companies in the vitamins minerals-supplement market must tailor their products to meet the unique needs of older consumers, potentially leading to innovations in formulations and marketing strategies.

E-commerce Expansion

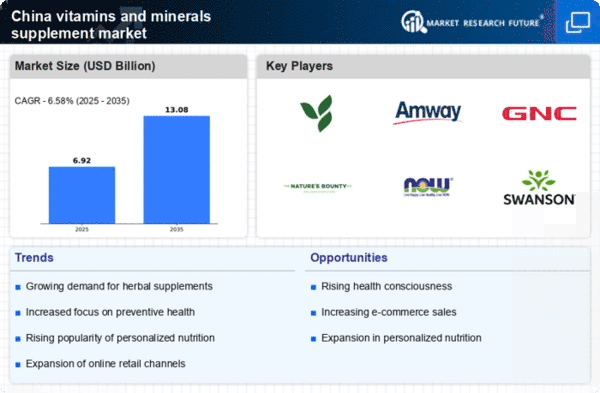

The rapid expansion of e-commerce platforms in China is transforming the vitamins minerals-supplement market. With the increasing prevalence of online shopping, consumers are more likely to purchase dietary supplements through digital channels. This shift is supported by the convenience and accessibility that e-commerce offers, allowing consumers to compare products and read reviews before making purchases. Recent data indicates that online sales of vitamins and minerals have surged, accounting for nearly 30% of total market sales. As a result, companies are investing in digital marketing strategies to enhance their online presence and reach a broader audience. This trend suggests that the future of the vitamins minerals-supplement market will be heavily influenced by the growth of e-commerce.

Rising Disposable Income

The growth of disposable income among Chinese consumers is a crucial factor influencing the vitamins minerals-supplement market. As individuals experience increased financial stability, they are more inclined to invest in health-related products, including dietary supplements. This trend is particularly evident in urban areas, where rising incomes have led to a greater willingness to spend on premium vitamins and minerals. Market data suggests that the average disposable income in urban regions has risen by over 10% annually, contributing to a robust demand for high-quality supplements. Consequently, brands that position themselves as premium or organic are likely to benefit from this trend, appealing to health-conscious consumers seeking effective solutions.

Growing Health Consciousness

The increasing awareness of health and wellness among the Chinese population is a primary driver for the vitamins minerals-supplement market. As consumers become more informed about the benefits of vitamins and minerals, they are more likely to incorporate these supplements into their daily routines. This trend is reflected in the rising sales figures, with the market projected to reach approximately $20 billion by 2026. The shift towards healthier lifestyles, coupled with a growing interest in preventive healthcare, suggests that the demand for vitamins and minerals will continue to expand. Furthermore, the influence of social media and health influencers plays a significant role in shaping consumer perceptions, leading to a greater acceptance of dietary supplements as essential components of a balanced diet.

Government Initiatives and Regulations

Government initiatives aimed at promoting health and wellness are playing a pivotal role in shaping the vitamins minerals-supplement market. Regulatory bodies in China are increasingly focusing on the safety and efficacy of dietary supplements, leading to stricter guidelines and quality standards. These regulations are designed to protect consumers and ensure that products meet specific health claims. As a result, companies that comply with these regulations may gain a competitive advantage in the market. Furthermore, government campaigns promoting healthy lifestyles and nutrition are likely to encourage greater consumption of vitamins and minerals. This supportive regulatory environment indicates a positive outlook for the vitamins minerals-supplement market, as it fosters consumer trust and encourages responsible product development.