Growing Focus on Data Sovereignty

Data sovereignty has emerged as a critical concern for organizations operating in China, significantly impacting the virtual private-cloud market. With stringent regulations governing data storage and processing, businesses are compelled to ensure that their data remains within national borders. This focus on data sovereignty drives the demand for local virtual private-cloud solutions that comply with Chinese laws. As organizations prioritize data protection and regulatory compliance, the virtual private-cloud market is likely to see an increase in offerings tailored to meet these requirements. Market analysts suggest that this trend could lead to a 15% increase in the adoption of local cloud services over the next few years, as companies seek to mitigate risks associated with data breaches and non-compliance.

Rising Demand for Scalable Solutions

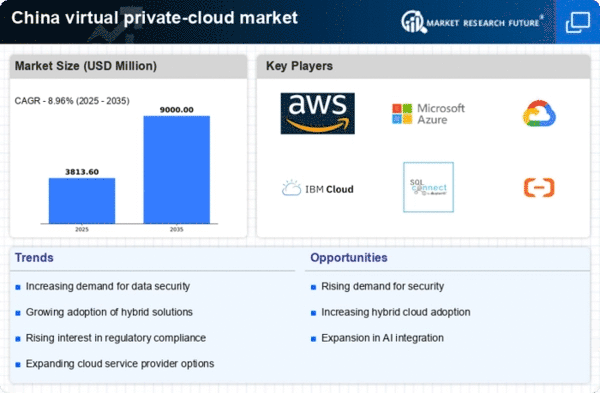

The virtual private-cloud market in China experiences a notable surge in demand for scalable solutions. As businesses expand, they require flexible cloud infrastructures that can adapt to their evolving needs. This trend is particularly pronounced among small and medium-sized enterprises (SMEs) that seek to optimize operational efficiency without incurring excessive costs. According to recent data, the market is projected to grow at a CAGR of approximately 20% over the next five years. This growth is driven by the increasing need for businesses to manage fluctuating workloads effectively. The virtual private-cloud market is thus positioned to benefit from this rising demand, as providers enhance their offerings to include more scalable options that cater to diverse business requirements.

Emergence of Industry-Specific Solutions

The virtual private-cloud market in China is witnessing the emergence of industry-specific solutions tailored to meet the unique needs of various sectors. As businesses increasingly seek customized cloud services, providers are developing specialized offerings for industries such as finance, healthcare, and manufacturing. This trend is indicative of a broader shift towards personalized cloud solutions that address specific regulatory and operational challenges. Market data suggests that the demand for industry-specific virtual private-cloud services could grow by 25% over the next few years, as organizations recognize the value of tailored solutions. The virtual private-cloud market is thus adapting to these demands, fostering innovation and enhancing service delivery to cater to diverse industry requirements.

Increased Investment in Cloud Infrastructure

Investment in cloud infrastructure is witnessing a significant uptick in China, directly influencing the virtual private-cloud market. Major technology firms and startups alike are channeling substantial resources into developing robust cloud platforms. This influx of capital is aimed at enhancing service capabilities, improving performance, and expanding geographical reach. Recent statistics indicate that investments in cloud infrastructure are expected to exceed $30 billion by 2026, reflecting a strong commitment to cloud technology. The virtual private-cloud market stands to gain from this trend, as enhanced infrastructure will facilitate better service delivery and attract more clients seeking reliable cloud solutions. This investment momentum is likely to create a competitive landscape, driving innovation and service diversification.

Government Initiatives Supporting Cloud Adoption

In China, government initiatives play a crucial role in promoting the adoption of cloud technologies, including the virtual private-cloud market. The Chinese government has implemented various policies aimed at fostering digital transformation across industries. These initiatives often include financial incentives, regulatory support, and the establishment of cloud computing standards. As a result, organizations are increasingly encouraged to migrate to cloud solutions, which enhances the overall growth of the virtual private-cloud market. Recent reports indicate that government-backed projects are expected to contribute significantly to the market's expansion, potentially increasing its value by over $10 billion by 2027. This supportive environment is likely to attract more businesses to explore virtual private-cloud options.