Emergence of 5G Technology

The rollout of 5G technology in China is a transformative factor for the virtual network-functions market. With its promise of ultra-fast data speeds and low latency, 5G is expected to revolutionize how network services are delivered. This technological advancement creates new opportunities for virtual network functions, as they can leverage the capabilities of 5G to enhance service offerings. Industry analysts predict that the adoption of 5G will lead to a market expansion of approximately 18% over the next few years. As businesses and consumers alike begin to harness the potential of 5G, the virtual network-functions market is likely to see a corresponding increase in demand for innovative solutions.

Growing Focus on Cost Efficiency

Cost efficiency remains a critical driver for the virtual network-functions market in China. Organizations are under constant pressure to reduce operational expenses while maintaining high service quality. Virtual network functions offer a compelling solution by enabling businesses to consolidate their network resources and minimize hardware investments. Recent studies indicate that companies can achieve up to 30% savings in operational costs by transitioning to virtualized network solutions. This financial incentive is likely to propel the adoption of virtual network-functions, as firms seek to streamline their operations and enhance profitability. The emphasis on cost efficiency is expected to shape the competitive landscape of the market significantly.

Government Initiatives and Support

The Chinese government plays a pivotal role in fostering the virtual network-functions market through various initiatives and support programs. Policies aimed at promoting digital infrastructure development and innovation are increasingly prevalent. For instance, the government has allocated substantial funding to enhance telecommunications infrastructure, which directly benefits the virtual network-functions market. This support is expected to catalyze growth, with estimates suggesting an increase in market size by approximately 20% over the next few years. Furthermore, regulatory frameworks are being established to encourage the adoption of advanced networking technologies, thereby creating a conducive environment for market expansion.

Rising Demand for Network Flexibility

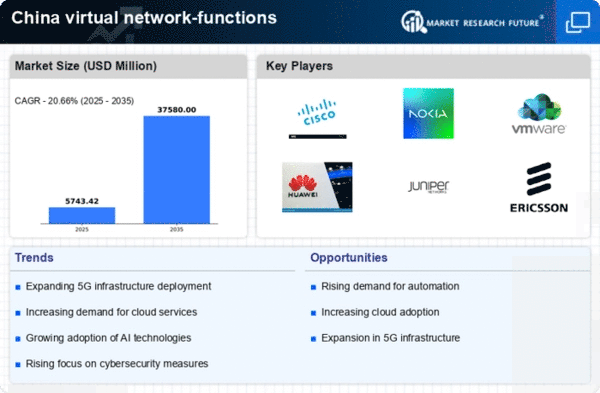

the virtual network-functions market in China is experiencing a notable surge in demand for network flexibility. Enterprises are increasingly seeking solutions that allow for rapid deployment and scalability of network services. This trend is driven by the need for businesses to adapt to changing market conditions and customer requirements. According to recent data, the market is projected to grow at a CAGR of 15% over the next five years. This growth is indicative of a broader shift towards more agile network architectures, enabling organizations to optimize their operations and reduce costs. As companies embrace digital transformation, the virtual network-functions market has become essential in providing the necessary infrastructure to support these initiatives.

Increased Internet Penetration and Connectivity

The virtual network-functions market in China is significantly influenced by the increasing internet penetration and connectivity across the nation. With over 900 million internet users, the demand for robust and efficient network solutions is at an all-time high. This surge in connectivity necessitates advanced networking capabilities, which virtual network functions can provide. As more individuals and businesses come online, the market is poised for substantial growth, with projections indicating a potential increase in market value by 25% in the coming years. Enhanced connectivity not only drives demand for virtual network functions but also encourages innovation in service delivery and customer engagement.