Government Initiatives and Regulations

The Chinese government has implemented various initiatives aimed at promoting energy efficiency and sustainability, which directly impact the ups battery market. Policies encouraging the adoption of renewable energy sources and energy storage solutions are becoming increasingly prevalent. For instance, the government has set ambitious targets for reducing carbon emissions, which may lead to a surge in demand for ups systems that support renewable energy integration. The ups battery market is likely to see a boost as manufacturers align their products with these regulatory frameworks, potentially increasing market penetration by 15% over the next five years. This regulatory environment fosters innovation and investment in advanced battery technologies.

Increased Awareness of Energy Management

There is a growing awareness among businesses and consumers in China regarding the importance of energy management and efficiency. This heightened consciousness is driving the adoption of ups systems as organizations seek to optimize their energy usage and reduce operational costs. The ups battery market is likely to see a surge in demand as companies implement energy management strategies that incorporate reliable power backup solutions. By 2025, it is anticipated that the market could grow by 12%, reflecting the increasing prioritization of energy efficiency in corporate strategies. This trend indicates a shift towards more sustainable practices, further solidifying the role of ups systems in energy management.

Growth of E-commerce and Digital Services

The rapid expansion of e-commerce and digital services in China has created a substantial need for reliable power solutions. As online retail and cloud computing services proliferate, businesses are increasingly investing in ups systems to safeguard their operations against power disruptions. The ups battery market is projected to benefit from this trend, with an estimated growth rate of 10% annually as companies prioritize the reliability of their power supply. In 2025, the market could see revenues exceeding $1.2 billion, driven by the necessity for uninterrupted service in a highly competitive digital landscape. This growth underscores the critical role of ups systems in maintaining operational efficiency.

Rising Demand for Uninterrupted Power Supply

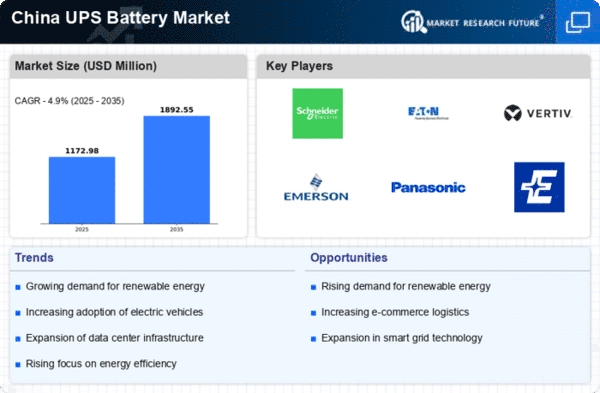

The increasing reliance on digital infrastructure in China has led to a heightened demand for uninterrupted power supply solutions. As businesses and consumers alike seek to mitigate the risks associated with power outages, the ups battery market experiences significant growth. In 2025, the market is projected to reach a valuation of approximately $1.5 billion, reflecting a compound annual growth rate (CAGR) of around 8%. This trend is particularly evident in sectors such as telecommunications, healthcare, and data centers, where continuous power is critical. The ups battery market is thus positioned to benefit from this rising demand, as companies invest in robust power backup systems to ensure operational continuity.

Technological Advancements in Battery Solutions

Technological advancements in battery solutions are reshaping the ups battery market. Innovations in battery chemistry, such as the development of advanced lead-acid and lithium-ion batteries, are enhancing performance and lifespan. These improvements are crucial for the ups battery market, as they enable systems to provide longer backup times and faster charging capabilities. As of 2025, the market is expected to witness a shift towards more efficient battery technologies, potentially increasing market share by 20%. This trend not only meets the growing demands of consumers but also aligns with the broader push for sustainable energy solutions, making it a pivotal driver in the industry.