Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices in China is creating new opportunities for the unified monitoring market. As industries increasingly adopt IoT technologies, the complexity of managing and monitoring these devices grows. Unified monitoring solutions are becoming essential for aggregating data from diverse IoT sources, enabling organizations to gain insights and improve operational efficiency. The unified monitoring market is poised to benefit from this trend, as businesses seek to implement comprehensive monitoring strategies that encompass both traditional IT assets and IoT devices. Recent estimates indicate that the number of connected IoT devices in China could reach 1 billion by 2025, highlighting the potential for growth in unified monitoring solutions tailored to this expanding ecosystem.

Growth of Cloud Computing Services

The rapid expansion of cloud computing services in China is significantly influencing the unified monitoring market. As more organizations migrate their operations to the cloud, the need for effective monitoring solutions that can manage cloud-based resources becomes paramount. Unified monitoring tools are essential for providing visibility across hybrid environments, ensuring that organizations can maintain performance and security. The unified monitoring market is likely to see increased adoption of cloud-native monitoring solutions, as businesses seek to leverage the scalability and flexibility of cloud technologies. Current projections suggest that the cloud services market in China could exceed $100 billion by 2025, which will likely drive further investments in unified monitoring capabilities to support these cloud infrastructures.

Regulatory Compliance and Governance

The evolving regulatory landscape in China is compelling organizations to adopt unified monitoring solutions to ensure compliance with various standards. Industries such as finance, healthcare, and energy are particularly affected by stringent regulations that require comprehensive monitoring of operations and data handling. The unified monitoring market is responding to this need by offering solutions that facilitate compliance reporting and risk management. As organizations strive to avoid penalties and maintain their reputations, the demand for effective monitoring tools is expected to rise. Recent data indicates that compliance-related investments in technology could reach upwards of $10 billion by 2026, further underscoring the importance of unified monitoring in meeting regulatory requirements.

Rising Demand for Real-Time Analytics

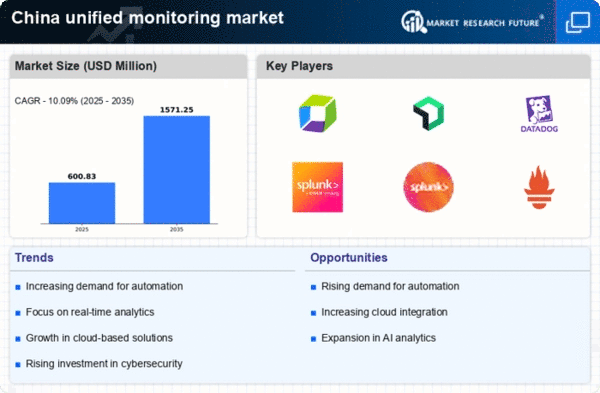

The increasing need for real-time data analysis is driving the unified monitoring market in China. Organizations are recognizing the importance of immediate insights for decision-making processes. This demand is particularly evident in sectors such as finance and telecommunications, where timely information can lead to competitive advantages. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 25% over the next five years. This growth is likely to propel the adoption of unified monitoring solutions, as businesses seek to integrate various data streams into a cohesive framework. The unified monitoring market is thus positioned to benefit from this trend, as companies invest in technologies that facilitate real-time data processing and visualization.

Increased Focus on Operational Efficiency

Organizations in China are increasingly prioritizing operational efficiency, which is significantly impacting the unified monitoring market. By consolidating monitoring tools into a unified platform, companies can streamline their operations, reduce redundancies, and enhance productivity. This shift is particularly relevant in manufacturing and logistics sectors, where operational bottlenecks can lead to substantial financial losses. The unified monitoring market is witnessing a surge in demand for solutions that provide comprehensive visibility across various operational processes. As businesses aim to optimize their resource allocation and minimize downtime, the market is expected to expand, with a projected growth rate of around 20% annually. This focus on efficiency is likely to drive investments in advanced monitoring technologies.